Account activation and management

- Who can access the portal?

Investors:

To be activated on the portal, you must be invested in a relevant Bennelong fund.

Note this does not include investments in the Bennelong Market Neutral Fund or Bennelong Long Short Equity Fund.If you have not signed up for the Investor Portal, please complete the Investor portal registration form and return it to our Client Experience team (details at the top of this page). If you are an mFund investor, you will also need to complete and return the Signature verification form for security purposes.

Advisers:

To be activated on the portal, you must have clients in a relevant Bennelong fund where you are appointed as the adviser.

Note this does not include investments in the Bennelong Market Neutral Fund or Bennelong Long Short Equity Fund.For security reasons, advisers have read-only access to their clients’ investments. Only direct account holders can transact on their investments.

If you are an adviser with investments in a Bennelong fund and haven’t yet received an activation email, contact our Client Experience team (details at the top of this page).

Adviser support staff can be granted their own login details to view client accounts for one or more advisers. To arrange this, please contact our Client Experience team.

- Can joint investors get portal access?

Yes, dual account holders can both have portal access. However, each investor must provide a unique email address and mobile number for two-factor authentication. Note only one investor is needed to conduct a transaction, but both will receive a notification informing them of the transaction.

- I have more than one account with Bennelong/consolidated portal access

If you have multiple accounts and would like to view them all in the Investor Portal, please ensure you list all investor numbers on Page 1 of the Investor Portal Registration Form.

If you list only one investor number, you will only be able to view that specific account in the portal.

- How do I access the portal?

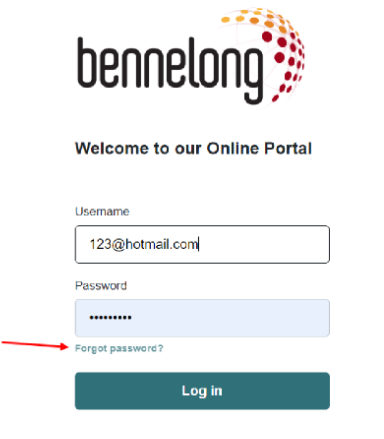

You can access the portal via the login page.

To be granted access to the portal, you’ll need a unique email address and a mobile number, as two-factor authentication is required for security purposes. In addition to your username and password, each time you log in to the portal, a unique one-time PIN will be sent to your mobile.

You will need to enter the one-time pin within 30 seconds. If you do not enter the PIN within 30 seconds, please click ‘Resend One-Time PIN’.

Note you will be logged out of the portal if it is inactive for 30 minutes.

- What’s my username?

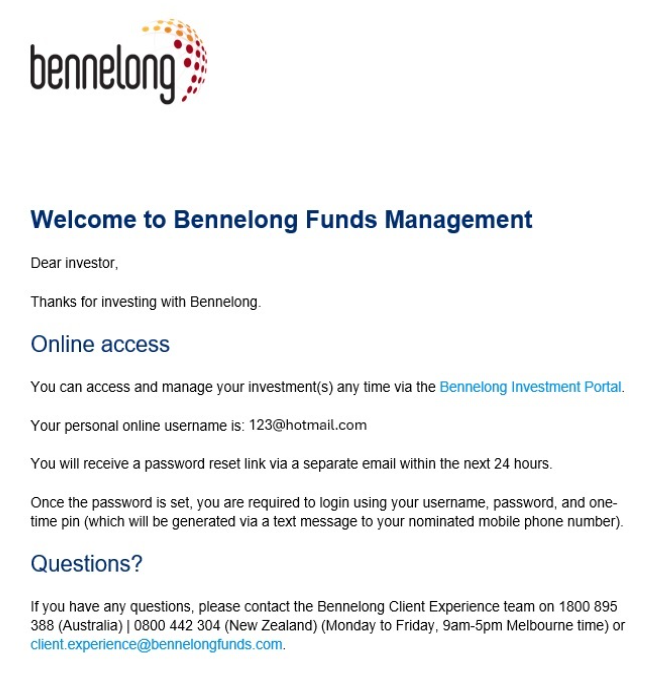

Once your account has been set up, you will receive two emails from client.experience@bennelongfunds.com.

One email will contain your username (example in the question below), and the other will contain a link to reset your password.

Your username is your email address. If you’re unsure which email address this is, contact the Client Experience team (details at the top of this page).

- How do I set up my password?

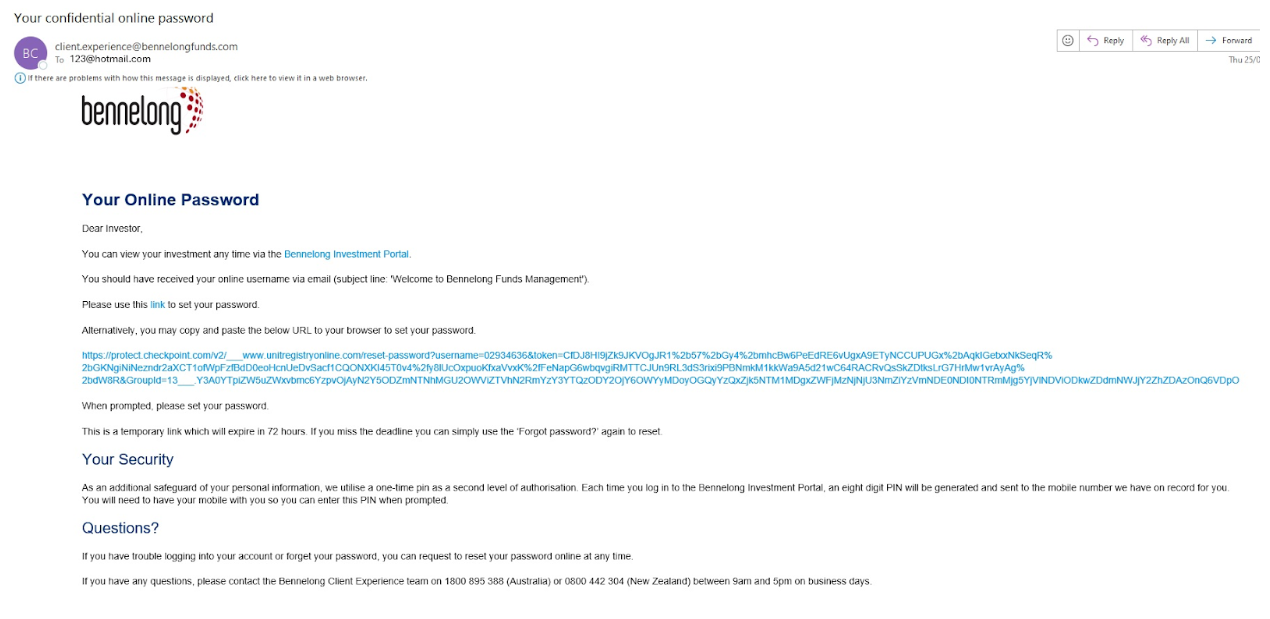

Once your account has been set up, you will receive two emails from client.experience@bennelongfunds.com.

One email will contain your username, and the other will contain a link to set your password.

Click the link in the email to log into the portal, or copy paste the link to your browser.Note you must clear any pre-populated fields and then enter your password manually to ensure it is correct.

Troubleshooting your account

- I forgot my password / my password link expired

If your password link has expired or you have forgotten your password, you can reset the password using the steps below.

- Visit Bennelong's Portal

- Click "Forgot Password? "

- Enter your username (noting that your username will also be your registered email address). Then click "Submit"

- A two-factor authentication pin code is then sent to your registered mobile number for security purposes. Enter the code and click "Continue".

- You will receive the message "Success! An email containing password reset instructions has been sent to your registered email address".

- A temporary password link will then be emailed through with a link to set up a new password.

- You will be automatically prompted to set up a new password in the portal. Please note the password will need to have the following:

- At least 8 characters long

- Contain at least one capital letter

- Contain at least one number

- Contain at least one special character i.e., !@#$%^&*

New passwords need to be different to any of your six previous passwords.

Upon completion of your new updated password, you will need to log in again with your new password.

You will again receive a new two-factor authentication pin code. After this is submitted, you can fully access the Investor Portal.

- My account is locked

If you make three unsuccessful attempts to log in, your account will be locked and an email may be sent to your nominated email address.

To unlock your account, please reset your password 60 minutes from your last log in attempt.

- Visit Bennelong's Portal

- Click "Forgot Password?"

- Enter your username (noting that your username will also be your registered email address). Then click "Submit”.

- A two-factor authentication pin code is then sent to your registered mobile number for security purposes. Enter the code and click "Continue".

- You will receive the message "Success! An email containing password reset instructions has been sent to your registered email address".

- A temporary password link will then be emailed through with a link to set up a new password.

- You will be automatically prompted to set up a new password in the portal. Please note the password will need to contain the following:

- At least 8 characters long

- Contain at least one capital letter

- Contain at least one number

- Contain at least one special character i.e !@#$%^&*

- New password needs to be different to any of your 6 previous passwords.

Upon completion of your new updated password, you will need to log in again with your new password.

You will again receive a new two-factor authentication pin code. After this is submitted, you can fully access the Investor Portal.

If you require any statements urgently, please contact our Client Experience Team.

- I didn’t receive a PIN on my mobile phone

If you are out of cellular range, you may not receive the PIN.

After three failed login attempts, your account will be locked, and you will not receive a PIN.

To unlock your account, you will need to reset your password 60 minutes after your last login attempt.

If you are unsure if the correct mobile number has been registered, please contact the Client Experience Team.

- I didn’t receive my password email

If you have not received emails with your username or password link, please check your junk or spam folders.

If you still cannot locate the email, please contact the Client Experience team (details at the top of this page) for further assistance.

Managing your investments

- Can I place trades via the Investor Portal?

If you don’t have an existing investment in any Bennelong fund, you can’t invest via the portal.

If you are invested via mFunds, please note that you cannot transact on the portal.

- Can I top up my existing investment on the portal?

Existing investors can make additional applications/redemptions via the Investor Portal.

To place an Additional Application, please follow the instructions below.

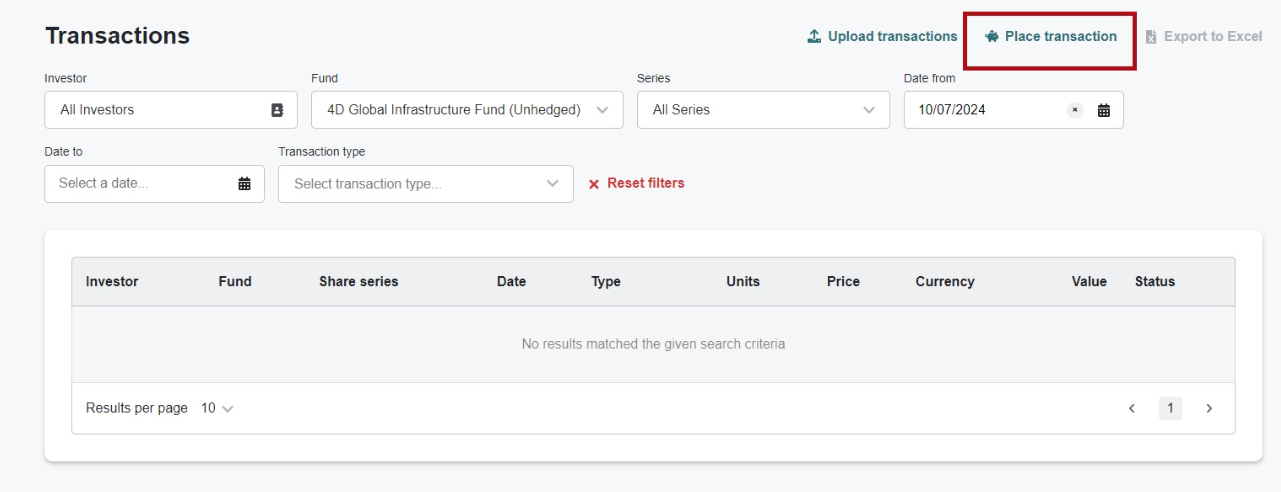

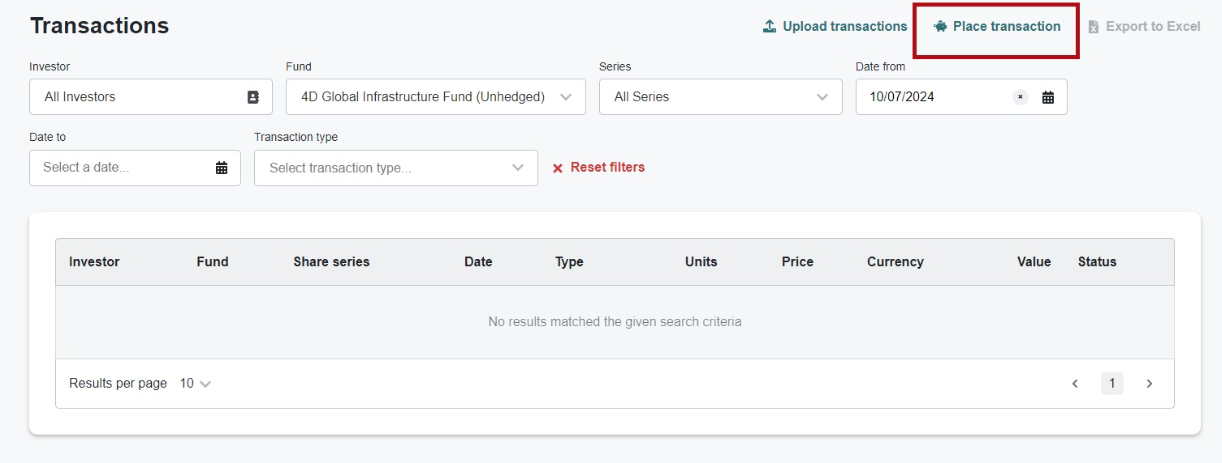

1. Click ‘Transactions’ Tab and select ‘Place Transaction'.

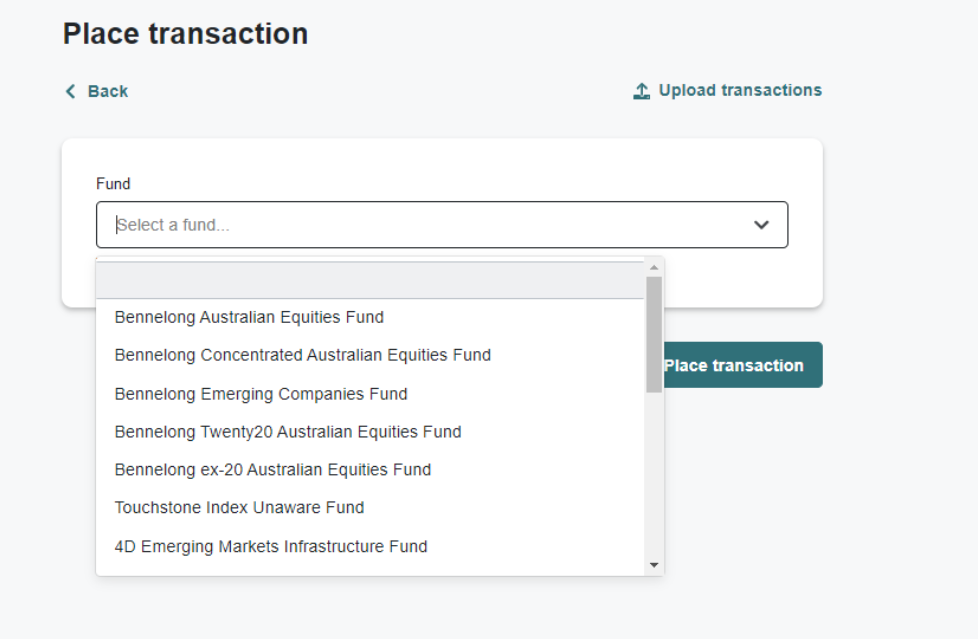

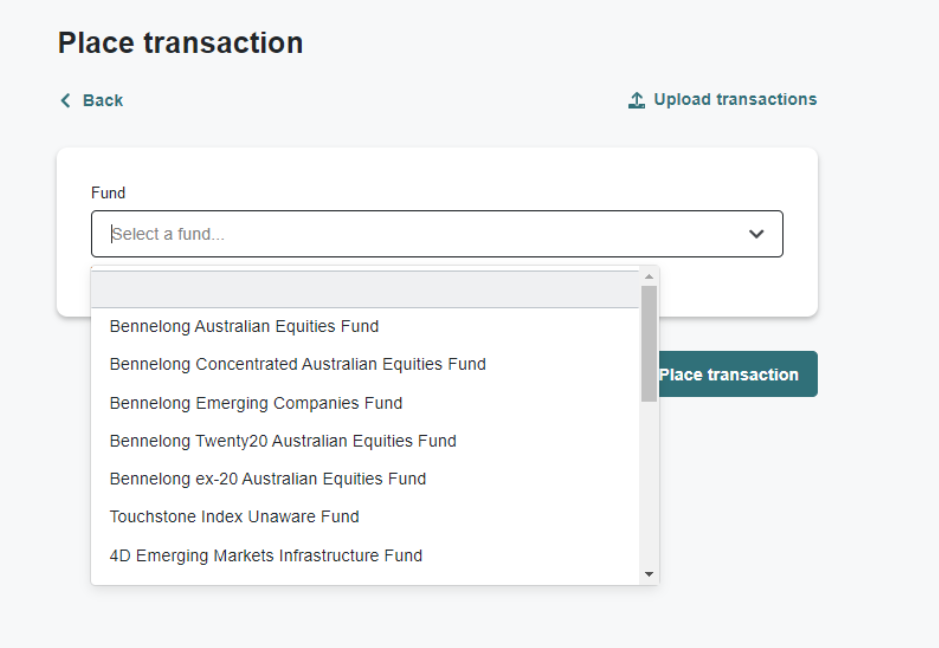

2. Select the fund you wish to transact in.

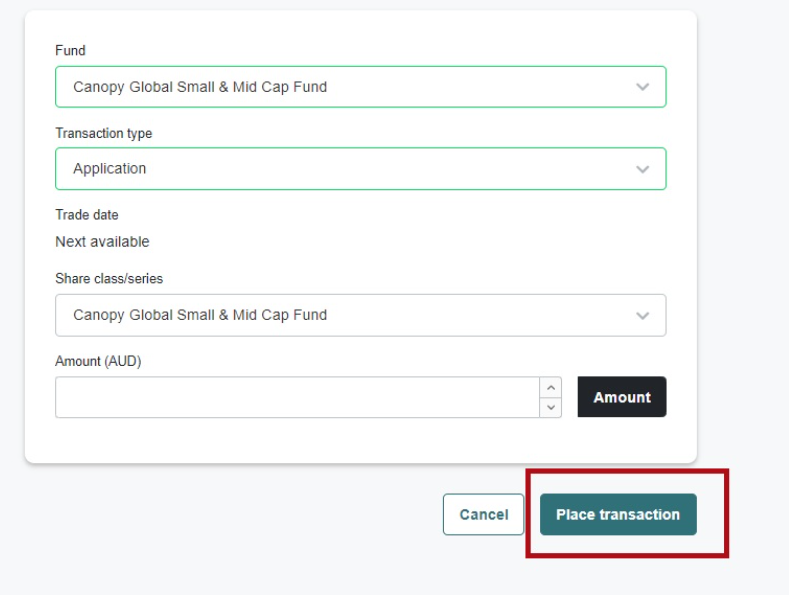

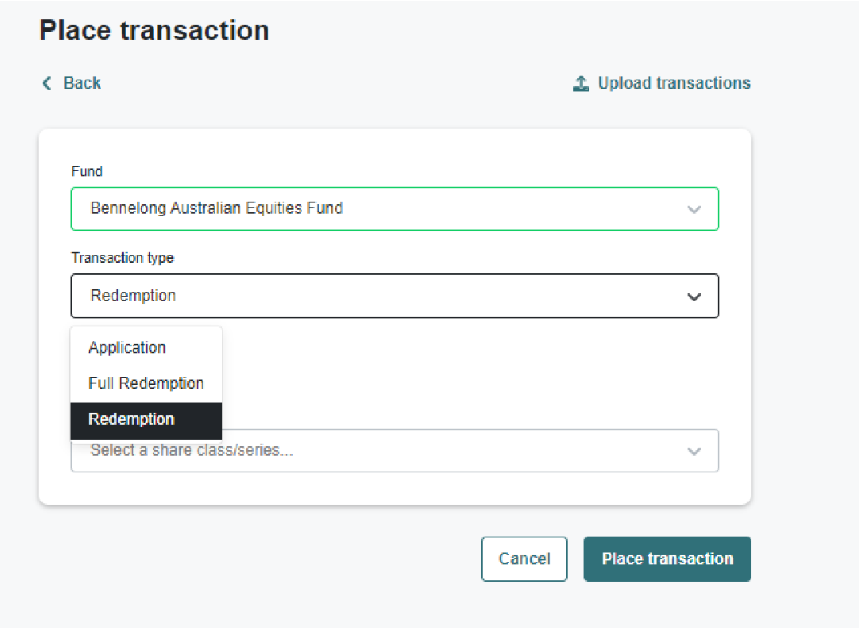

3. Select the ‘Transaction Type’ as ‘Application’. Ensure you have checked the minimum application amount for the relevant fund.

4. Enter the $ amount of the Transaction (application minimums / minimum withdrawal amounts apply).

5. Select ‘Place Transaction’.

6. A confirmation page will appear. Read this carefully and select ‘Confirm’ once you are ready.

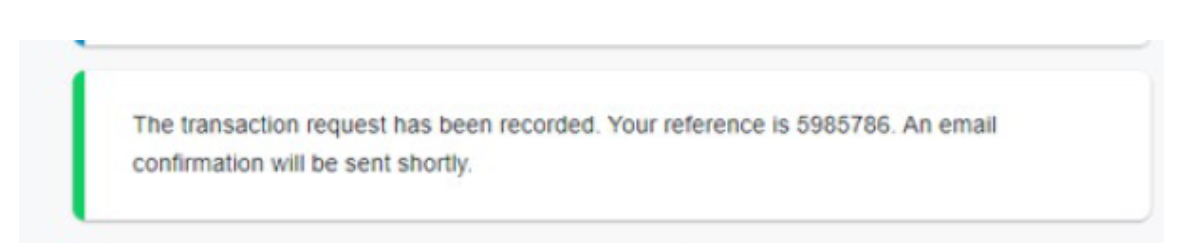

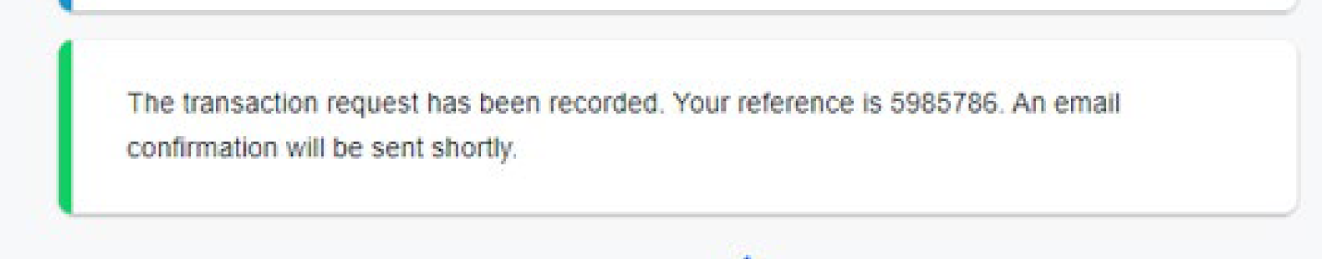

7. Once you confirm the transaction, an automated reference number will be generated and emailed to your nominated email address.

If you make an additional application into the fund currently invested in, please transfer the full investment amount via BPay or EFT (funding must be received within 30 days).

Via BPAY

Biller Code: 266775

Reference Number: 99 Insert Investor Number 280*****Via EFT

Bank: Citibank NA, Australia

BSB No: 242 000

Account No: 200562003

Account Name: Bennelong Applications

Reference: Account Insert Investor Number 280*****Note transfers can only be made from your (i.e. the investing entity’s) bank account. We can’t accept third party transfers.

- Can I make a withdrawal or redeem my investment on the portal?

Yes, you can submit full and partial redemptions on the portal. Note minimum withdrawal amounts apply.

1. Click the ‘Transactions’ Tab and select ‘Place Transaction’.

2. Select the fund you wish to transact in.

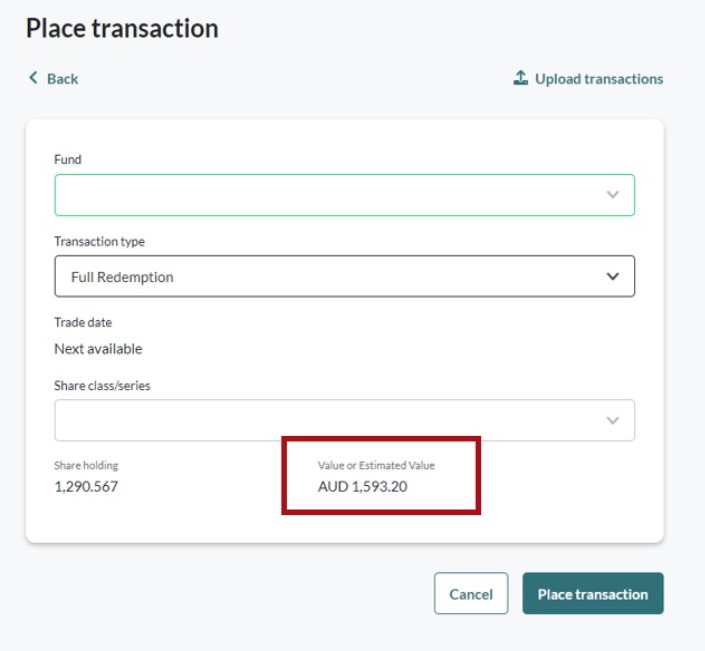

3. Select the ‘Transaction Type’ as ‘Redemption' or 'Full Redemption’.If you are making a full redemption, please select 'Full Redemption'.

If you are making a partial redemption, please select 'Redemption’ and enter the $ amount of the transaction.

Note minimum withdrawal amounts apply.

Please note that the redemption value is an estimate and not final.6. A confirmation page will appear. Read this carefully and select ‘Confirm’ once you are ready.

7. Once you confirm the transaction, an automated reference number will be generated and emailed to your nominated email address.

Click here for information on when you can expect fund settlement to occur.

- Can I switch my investment to another fund on the portal?

This cannot be completed on the portal. Please complete Switch form and email it to client.experience@bennelongfunds.com

- Can I perform an off-market transfer on the portal?

No. Please click here for instructions.

- Can I update my personal details on the portal?

To update your details, please use the menu located on the left corner of the Investor Portal.

To update your email address, registered/mailing address, use the ‘My details' tab and click ‘Edit Details’. Once you have updated the relevant details please select ‘Update Details’.

mFund investors cannot update details in the portal. For any changes, please contact your broker.

If you are an adviser, to update any personal details, please contact the Client Experience team.Direct investors

Please note, that you cannot update your mobile number, adviser details, username, trustees, legal name(s) or TFN details on the investor portal. You must use our Change of Details form.

If you update your email address on the portal, please note that it may take some time for it to be updated.- Can I update my banking details on the portal?

To update your banking details, select ‘Banking details’

Once you enter the new banking details, click ‘Save’.

Note banking details can take up to five business days to be reflected on our system.

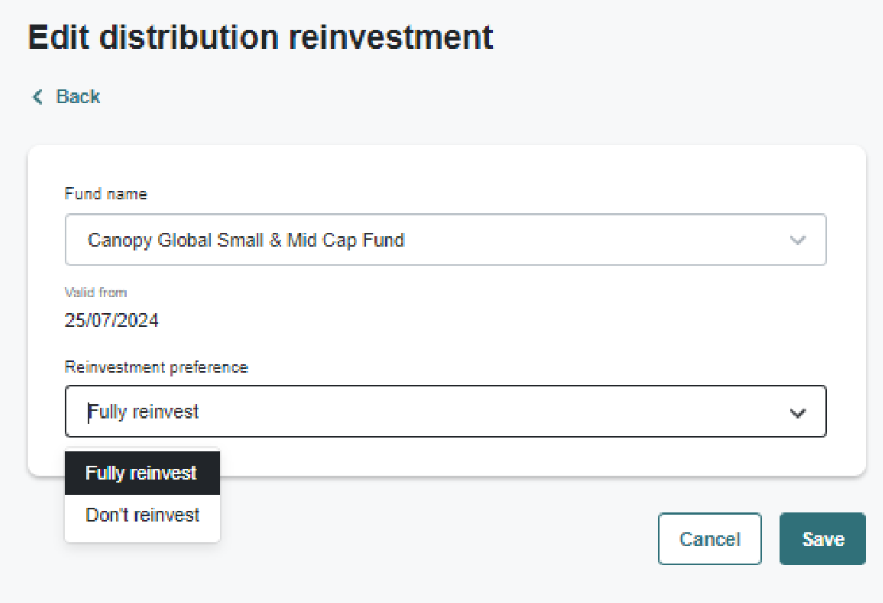

- Can I update my distribution option on the portal?

To update the distribution option, please select ‘Distribution Options’.

If you would like to reinvest your distributions, please select ‘Fully reinvest’.

If you would like for your distributions to be paid out into your nominated bank account, select ‘Don’t reinvest’.

Once you have updated your reinvestment preference, click ‘Save’.

- How do I run a full transaction history?

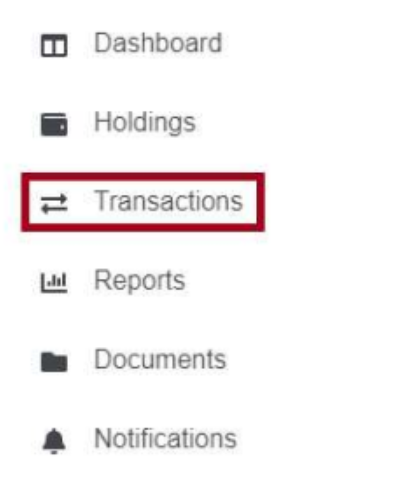

- Click ‘Transactions’ on the left-hand toolbar. Advisers will also need to enter the investor name or number they wish to search.

2. Specify a date range. If you would like a full history since inception, leave the dates defaulted to ‘No Start Date’ and ‘No End Date’.

3. The system will automatically load with your request.

4. Click on the export to Excel option at the top right of the screen to export the file in .xml format.

- How do I access statements?

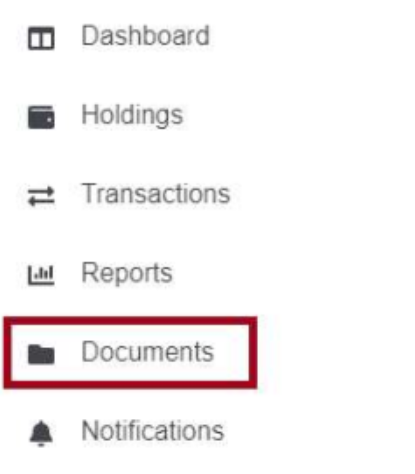

Statements can be found by clicking on documents on the left-hand toolbar.

Statements will generally be uploaded one business day after they are generated. Visit our FAQs page for more information on statement types and intervals.

Historical statements are available in PDF form by chronological order of value date and / or date produced. This can be sorted according to your preference.

- How do I view current holdings?

1. Click ‘Holdings’ on the left-hand side toolbar. Advisers will also need to enter the investor name or number they wish to search.

2. You can change the date range by 'Holdings as of’.

If the ‘Total’ balance is showing as zero for the current date, select the previous business day to see the latest available balance. All unit prices are calculated at end of day. For all market value details, please use the previous business day’s date.

The example above was generated on 31 July 2024 with the previous day’s date.

- How do I check the status of a transaction?

Click ‘Transactions’ on the left (advisers will also need to enter the investor name or number they wish to search).

Clear any date fields and the page will automatically refresh.

Find the transaction in question and check the ‘Status’ column.

If the transaction does not appear, your instruction has either not been received or has not been processed. If the status is ‘Pending’, the instruction has been received and is awaiting either funding or unitisation. If the status is ‘Confirmed’, the transaction has been processed.

Updating details and other questions

- Can I update my details on the portal?

Some account details can be updated via the portal, including your address, email address, distribution preference, bank account (two-factor authentication required) and password.

Note that amending your email address in your contact details will update your username. This normally happens a few days after you change your email address.

Your mobile number, account entity type, Tax File Number, financial adviser, and account signatories cannot be updated on the portal. To update these details, go to our Forms and documents page and complete the Change of details form.

- How is my personal information protected?

We take cyber security and your privacy very seriously, and have controls in place to protect your information and accounts.

The portal, which is managed by our registry service provider Citi, can only be accessed using multi-factor authentication. Citi maintains strict security protocols and testing around housing customer data. You will receive occasional emails from Citi, but if you are ever unsure or suspicious about an email or text relating to your Bennelong investments, please contact our Client Experience team immediately (details at the top of this page).

There are also a number of steps you can take to help safeguard your personal information against cyber threats. Update your devices and software promptly, be vigilant about clicking any hyperlinks, use strong passwords, (where possible) multi-factor authentication, and regularly back up your files.

For more information, visit the Australian Cyber Security Centre.

- Can I access forms via the portal?

Forms can be accessed on our Forms and documents page. There is also a link to the page in the footer of the portal.

- Can I see my platform holdings on the portal?

We do not have visibility for investors invested via a platform. Contact your platform service provider for details.

- Can I see my platform holdings on the portal?

If there has been an internal change of advisers, an adviser leaves, or you need to remove a client/adviser relationship, contact our Client Experience team (details at the top of this page).

- Can I see clients for other advisers in my practice?

Advisers can only see their own list of clients, but support staff can be granted their own login details to view client accounts for one or more advisers.

If you require access to view additional clients, contact our Client Experience team (details at the top of this page).

- Why can't I see all my clients?

If you can't see your direct/ mFund clients, contact our Client Experience team (details at the top of this page).

Note, we don't have access to your clients invested with a platform. Please contact our platform service provider for client details.

- Can I access past AML/KYC documents?

Those documents are not available via the portal. Contact our Client Experience team (details at the top of this page).