Driven by three underlying macro trends – the increasing cost of advice, the increasing digitisation of our lives, and the consumer preference for ad hoc, piece by piece advice – digital advice is likely to prove critical in allowing advisers and licensees to provide advice more efficiently, at lower cost, and in a more engaging way. Whilst the foreshadowed legislative streamlining of advice that could result from QAR would undoubtedly accelerate the adoption of digital advice technologies, the train has, in reality, already left the station, and the question is more when, not if, digital advice will be normalised.

But just as the advice landscape has been rapidly evolving, so too has our understanding and concept of what digital advice actually means.

Not many years ago, most of us interpreted the term ‘digital advice’ to mean ‘robo-advice’, which, in the absence of any precedent, was viewed by advisers as an existential threat, a faceless competitor that could eventually put them out of business by providing a cheap, algorithm-based, 24/7 service.

But times have changed. With the benefit of actual market experience, and countless research studies, it has become clear that consumers – even younger ones – still demand a degree of expert human interaction as part of their financial experience. Advisers too have changed their perceptions, realising the potential for technology to drive both efficiency and a superior client experience.

Increasingly, it is being recognised that the future of digital advice is a hybrid one, where consumers can – depending on their needs and where in the advice journey they are – access a combination of digital self-serve, algorithm driven information, education, and even advice, along with the human touch of a licensed financial adviser. The approach therefore becomes one of ‘do it together’ (with an adviser), rather than ‘do it yourself’ (with a bot).

In this article, we will explore this new context for digital advice. We will revisit the underlying macro trends powering its growth, and examine the technology solutions advisers are using. A practical framework for advisers looking to build their own digital hybrid advice offering will also be provided.

The ubiquity of technology, especially for younger clients

Technology is now a ubiquitous part of our daily lives. Consumers research and purchase everything from fashion to travel to cars online. They are also increasingly comfortable conducting financial transactions online, from simple payments and everyday banking to trading shares and making insurance claims. Decisions to engage, and stay with, a financial adviser, are also increasingly being based on the quality of the adviser’s digital experience.

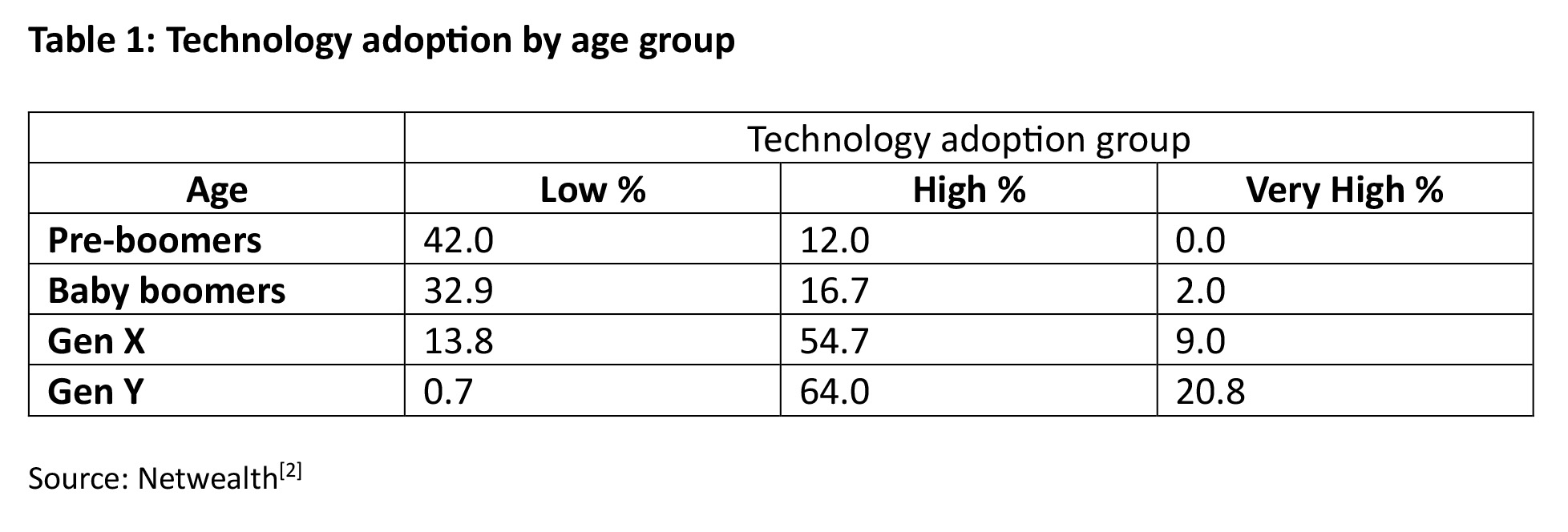

Crucially, the usage and confidence with technology is higher among younger ages. But by ‘younger’ we aren’t talking about the teenage Tik Tok generation, we are talking about Generations X and Y, very much the advice consumers of the present. This is demonstrated in Table 1, below.

US research by Refinitiv[3] suggests that around one third of Gen X (who are now aged 43 – 58) and a similar proportion of Gen Y (now aged 29 – 42) consider a wealth manager’s digital capabilities before choosing an adviser.

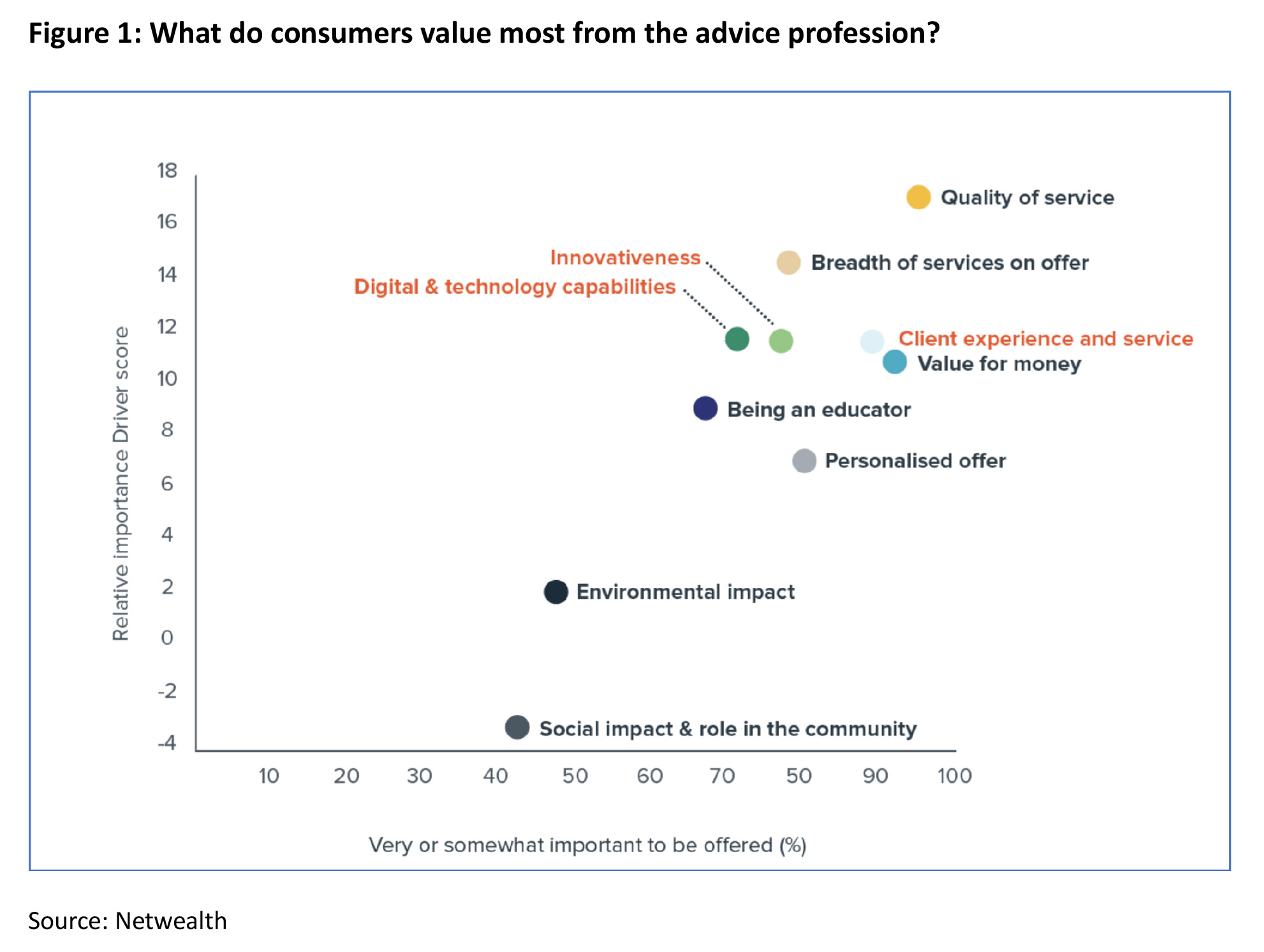

Similarly, research by Netwealth into the aspects of advice most valued by consumers found digital capabilities and innovation were both important[4].

The rising cost of advice

Studies have shown cost has long been one of the biggest barriers to consumer uptake of financial advice. And that barrier has only become bigger. Thanks to an onerous regulatory burden and dwindling adviser numbers, advice fees have continued to climb, well in excess of inflation.

Data compiled into the ‘Padua Advice Fee Data Report’ for FY22 shows initial advice fees charged by advisers on a per-advice-document basis increased 16 per cent, from $2,859 in FY21 to $3,315 in the past financial year[5]. Ongoing advice fees saw an even larger increase of 33 per cent from $3,656 in FY21 to $4,865 in FY22.

Adviser Ratings research6 suggests that while many consumers are willing to pay for advice, there is a large differential between the amount they are prepared to pay, and the cost of providing that advice. In contrast with the $3 – $4k costs mentioned above, a massive 61% of consumers said they would expect to pay less than $500 for advice. An additional 22% said they would pay between $500 and $1,000, and only 5% would be prepared to pay between $2,500 and $5,000.

In this context, the heightened focus on a technology driven path to lowering the cost of advice is understandable.

[1] https://treasury.gov.au/sites/default/files/2023-01/p2023-358632.pdf

[2] https://www.netwealth.com.au/web/insights/the-advisable-australian/the-advisable-australian-2021_six-dimensions-guide/

[3] https://www.refinitiv.com/perspectives/future-of-investing-trading/are-wealth-advisors-still-relevant-in-the-digital-age/

[4] https://www.adviceintelligence.com/blog/quality-of-advice-review-modern-adviser

[5] https://www.professionalplanner.com.au/2022/10/unsurprisingly-advice-fees-are-still-rising/