HNW clients are more exposed to disruption

2022 ushered in a new period of financial uncertainty around the world.

A prolonged market downturn was accompanied by runaway inflation and a ratcheting up of interest rates, leaving consumers feeling bruised and unsure where to turn. House prices have plunged, leaving some owners facing a negative equity scenario.

Investors, too, experienced their share of pain, with bonds and equities both delivering negative returns, leaving a hole in many superannuation balances, and leading many to question traditional investment wisdom.

One group of investors that has arguably experienced the most disruption in the past 12 to 18 months are the high net worth (HNW) individuals. Not just because they tend to be the most exposed to market risk, and generally have more at stake financially, but because many of the pillars underpinning their financial strategies have come under intense pressure.

Building, protecting and transferring wealth has always been complex, but now especially so. The preference of many HNW individuals to adopt a DIY approach is looking increasingly questionable.

In this article, we examine the evolving landscape for HNW individuals, looking at the challenges they currently face and how – with the help of financial advisers – they are responding and positioning themselves for 2023 and beyond.

Who are the HNW and what do they look like?

A quick search reveals a number of definitions of HNW in use in Australia, including:

- the Investopedia definition[1] – $1 million in liquid assets (family home excluded)

- the Coredata definition[2] – $1m in the share market, or earning an annual income of $450k and over (family home excluded), and even

- the ASIC sophisticated investor definition[3] (annual income over $250k or net assets of $2.5m).

To be consistent with the Australian-focused research – and because rocketing real estate prices are rendering the ASIC definition less meaningful every day – this article will use the $1m in net investable assets criterion common to both Coredata and Investopedia.

Across the globe, according to Capgemini’s 2022 World Wealth Report[4], there are around 22 and a half million HNW investors (of these, around 200k are classified as ultra-high net worth individuals, with net investable assets in excess of $30m USD).

In Australia in 2022, the HNW segment was estimated by Investment Trends[5] to comprise around 625,000 individuals, investing more than $ 2.8 trillion AUD.

The millionaire next door

As tempting as it is to think of HNW as one homogeneous group – that is perhaps largely male, middle-aged and professional – in reality, today’s HNW client is just as likely to be a female entrepreneur or a young tech firm founder. And the stereotypical signs of wealth – expensive car, luxury brands – are not always present. Today’s HNW individual could well be your neighbour.

While various studies[6] suggest the average age of a HNW investor is around 60, that average is dropping as more wealth finds its way into the hands of millennials.

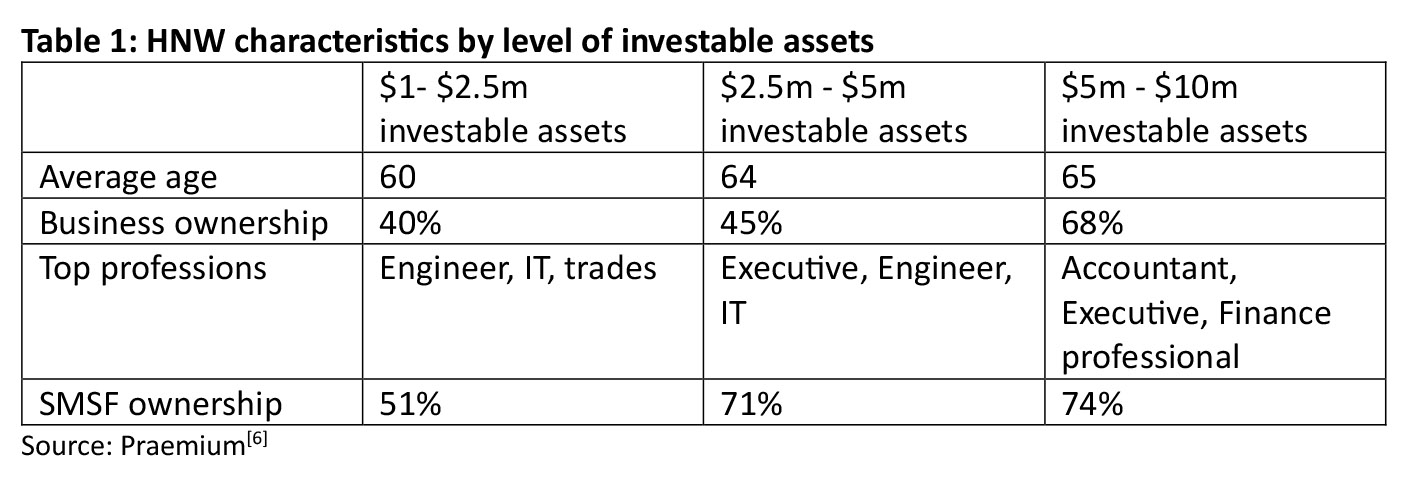

Segmenting the HNW by wealth tiers reveals differences in profile and behaviours.

The rising economic power of female investors is also a standout trend around the world, and is redefining the way firms are approaching this segment.

Global analysis[7] reveals that females hold around 40% of all US wealth, and a third of Australian wealth. But they are growing their wealth around 40% faster than males, and are expected to inherit 70% of global wealth over the next two generations. By 2030, females are projected to manage two-thirds of all household wealth.

To continue reading and receive CPD points, view the original article on AdviserVoice’s website.

[1] https://www.investopedia.com/terms/h/hnwi.asp#:~:text=Key%20Takeaways,for%20increased%20and%20better%20benefits

[2] https://www.newmodeladviser.com.au/3335/six-things-that-are-on-the-minds-of-australias-high-net-worth-investors/

[3] https://moneysmart.gov.au/glossary/sophisticated-investor

[4] https://worldwealthreport.com/download-report.html

[5] https://www.ifa.com.au/news/32127-aussie-high-net-worth-investor-numbers-steady

[6] https://www.praemium.com/hnw-investor/

[7] https://www.bcg.com/publications/2020/managing-next-decade-women-wealth