Unless you have been living on another planet recently, it has been hard to avoid the topic of artificial intelligence. While ‘AI’ has actually been around for a long time, it was really the release of ChatGPT at the end of November 2022 that sent the whole world crazy for AI.

A little like the industrial revolution, there are two perspectives from which to view the AI ‘revolution’. There’s the pessimistic perspective of which jobs are most at risk of being replaced by AI (the good news for you as the reader is that financial advisers aren’t high on that list, the bad news for me as the author is that copywriters are!), and then there’s the excitement about the endless possibilities for AI to revolutionise our lives and indeed just about every field of human endeavour. This is the perspective that sees the share price of Nvidia runway ahead of its actual current earnings.

But regardless of which perspective you take, and how futuristic you may think AI is, the reality is that AI is already here, and is already being used by financial advisers in Australia, to deliver better customer experiences, to make better decisions, and to operate more efficiently.

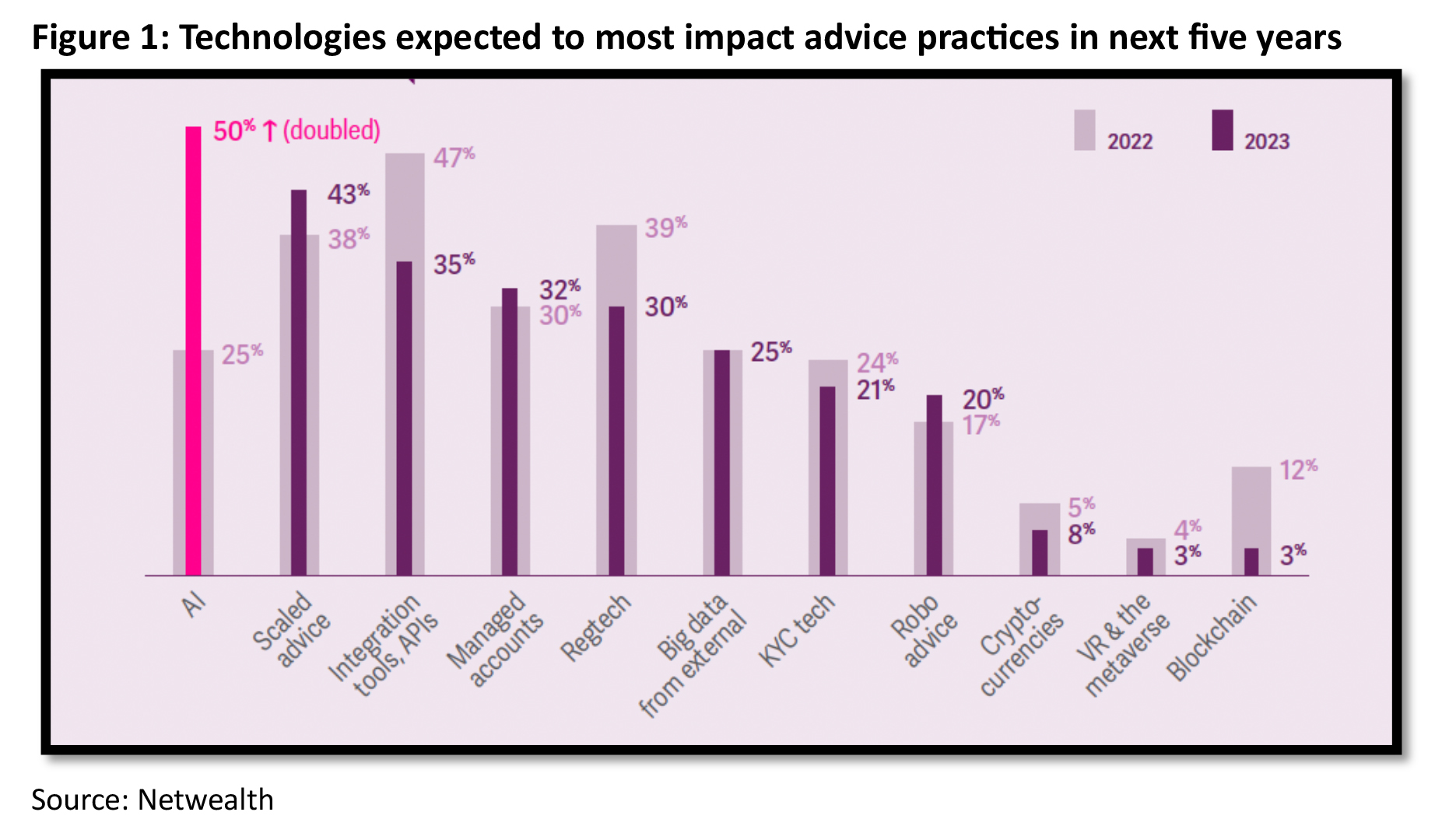

Reinforcing this point, a recent study[1] of Australian advisers found that most believed AI would be the technology that had the greatest impact on advice practices over the next five years.

In this article, we will examine AI through a practical lens, exploring the ways it can be used in conjunction with existing technologies to improve adviser and advice practice performance across portfolio construction, the advice process, the client experience, administration, compliance, and marketing.

First – a recap

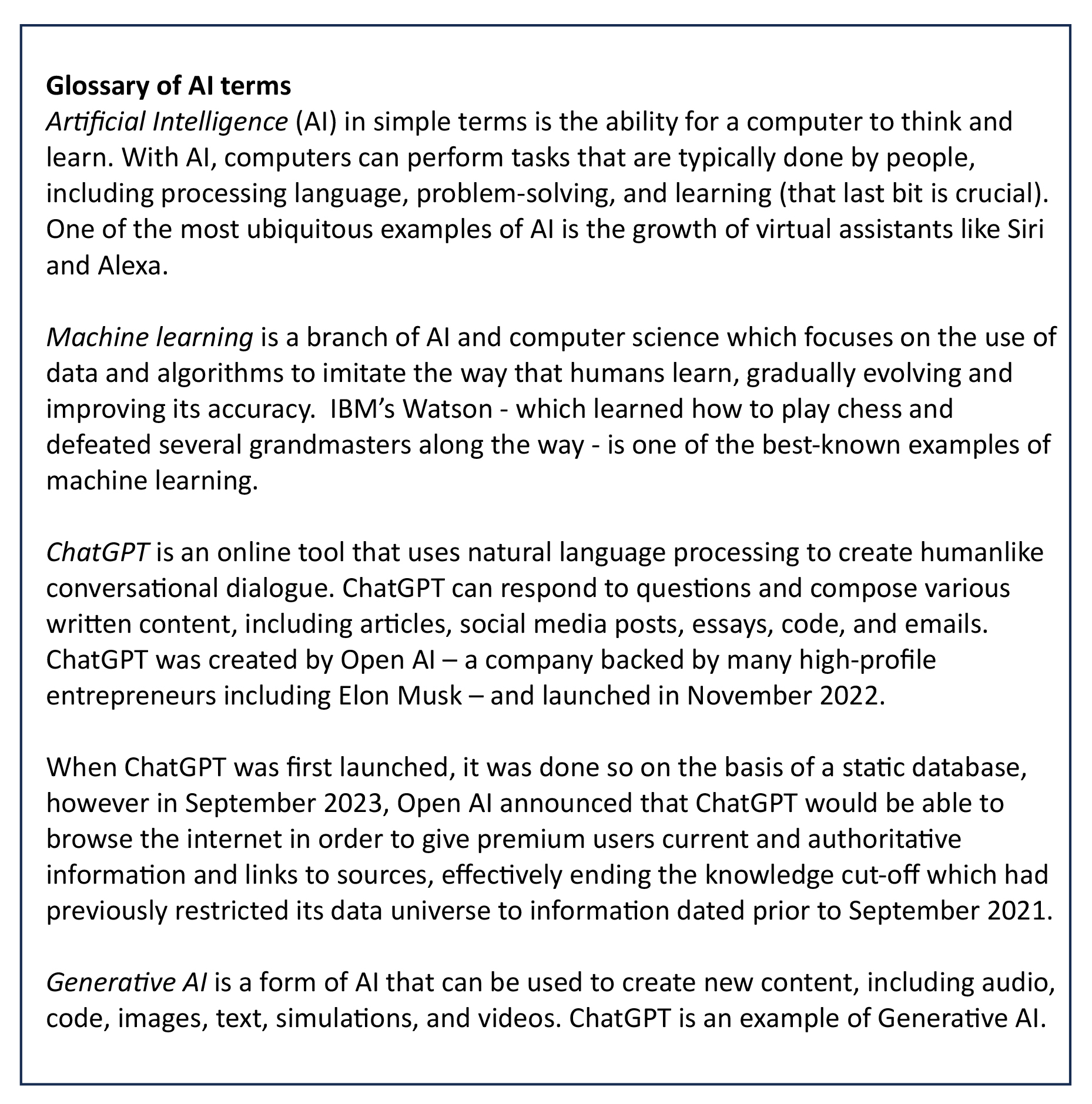

Before we begin our exploration, it is worth briefly recapping some of the common language used in conversations about AI.

AI will replace jobs – but advisers shouldn’t be worried

Much has been made of the likelihood of AI cutting a swathe through the job market. Certainly, as with any technological advance, an impact on the workforce is to be expected. But AI promises quite the disruption. A report[2] published by the World Economic Forum in 2020, for example, predicted 85 million jobs will be replaced by AI by the year 2025. Mckinsey’s more conservative 2021 estimate[3], on the other hand, is 45 million by 2030.

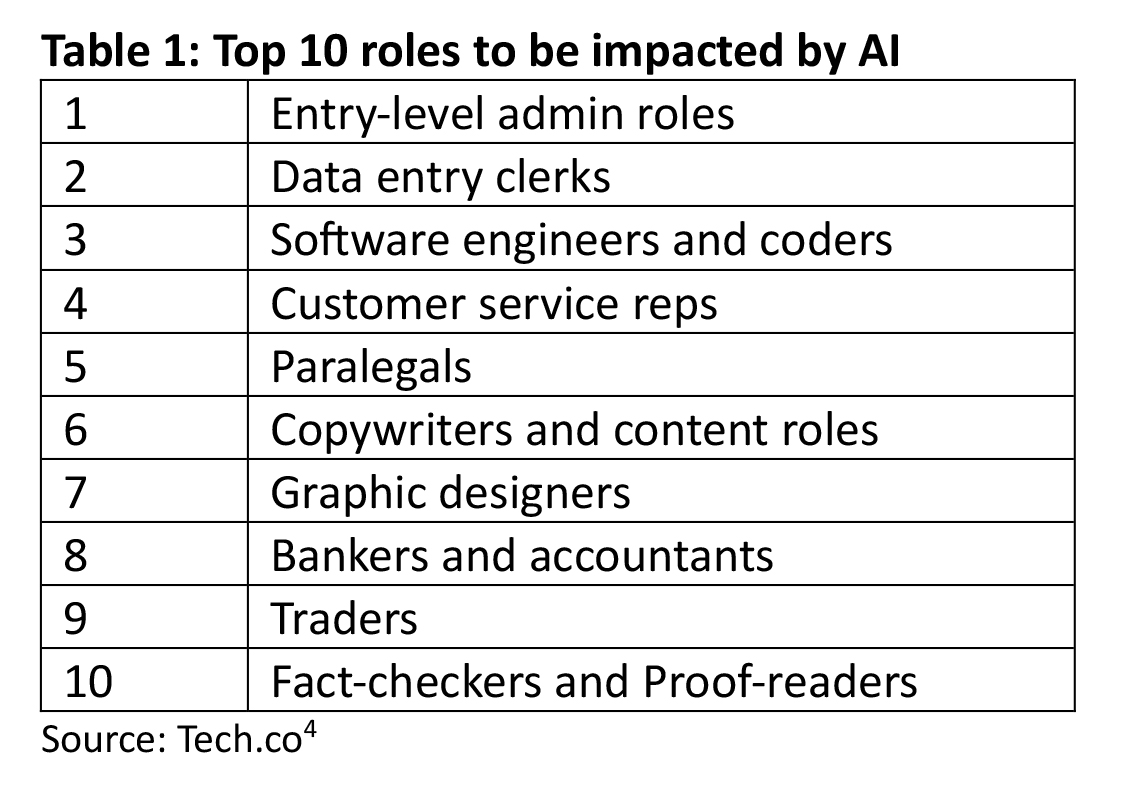

One recent list of roles most likely to be impacted showed the power of AI to generate content, with the top 10 list including copywriters, graphic designers, and even software coders.

It may or may not come as a surprise that ‘financial adviser’ doesn’t feature in such lists. Despite the predicted surge of interest in pure robo-advice (which AI is well positioned to support), the real-life market experience, and countless research studies, show that people still want the human touch in their advice, partly because they don’t fully trust machines to get it right.

The latest survey to reinforce this point was conducted by CNBC, which found that the vast majority of adults – 63% – aren’t interested in using generative AI tools specifically for financial advice[5].

A further survey[6] by the CFP Board, found that, of the 4% who are already using AI tools for financial advice, more than half (51%) are verifying the information and recommendations they receive with a real – human – financial adviser.

To continue reading and receive CPD points, view the original article on AdviserVoice’s website.

[1] https://www.netwealth.com.au/web/insights/netwealth-2023-advicetech/

[2] https://cepr.org/voxeu/columns/impact-artificial-intelligence-growth-and-employment#:~:text=The%20World%20Economic%20Forum%20concluded,information%20security%20and%20digital%20marketing.

[3] https://slate.com/technology/2021/03/job-loss-automation-robots-predictions.html

[4] https://tech.co/news/ai-job-replacement-experts-reveal-risk-roles

[5] https://www.cnbc.com/2023/09/12/3-in-10-adults-would-use-ai-for-financial-advice-cnbc-survey-finds.html

[6] https://www.cfp.net/-/media/files/cfp-board/knowledge/reports-and-research/trust-but-verify-deck.pdf?_zs=sIctj1&_zl=j9TA9