The introduction to a 2016 paper by global consulting firm KPMG, Transforming Client Onboarding[1], contained the following observation:

“Client onboarding is a largely manual, error prone, time -consuming, incomplete process. It often aggravates consumers and financial firms alike.”

Fast forward to financial advice in 2022 and this statement still holds true.

Firstly, the onboarding process is the first opportunity to deliver a seamless customer experience – consistent with contemporary consumer expectations – and demonstrate value before the benefits of your advice have started to flow through. As such, it can make or break the client relationship.

Secondly, client onboarding has traditionally been a costly and highly resource intensive process. Improving the efficiency of the onboarding process can therefore have a dramatic effect on the cost to serve, and in turn the overall sustainability of the practice.

Conversely, the risks of getting it wrong are substantial:

- unhappy clients, who may drop out of the process or switch advisers

- clients will be more reluctant to provide referrals

- clients may not appreciate your full value proposition and breadth of offering

- time is wasted with prospects not suited to your practice

- misalignment between service expectations on the client’s part and delivery on your part (resulting in under or over servicing)

- lower staff engagement.

For too long, onboarding has been dismissed as a back-office function, a compliance focussed ‘necessary evil’, tangential to a positive customer experience.

At a time when 100,000 advice clients have exited the sector in the last 12 months alone[2], the impact of onboarding on both client satisfaction and the cost of advice should arguably make it one of the top business priorities for advice practices around Australia.

Don’t take client loyalty for granted

There’s a long-standing narrative within advice that non advised consumers start off as ambivalent towards the value of advice, but are delighted once they get it. And it is certainly true that advice clients on the whole demonstrate high levels of satisfaction.

Three quarters of respondents to a recent study[3] of Australian advice clients said the advice had improved their financial wellbeing. 88.5% said the advice had given them greater peace of mind financially, and 86.2% said it had given them greater control over their financial situation.

But is it the adviser or the advice itself that customers are attributing the value to, and what does this mean for their loyalty to an individual adviser?

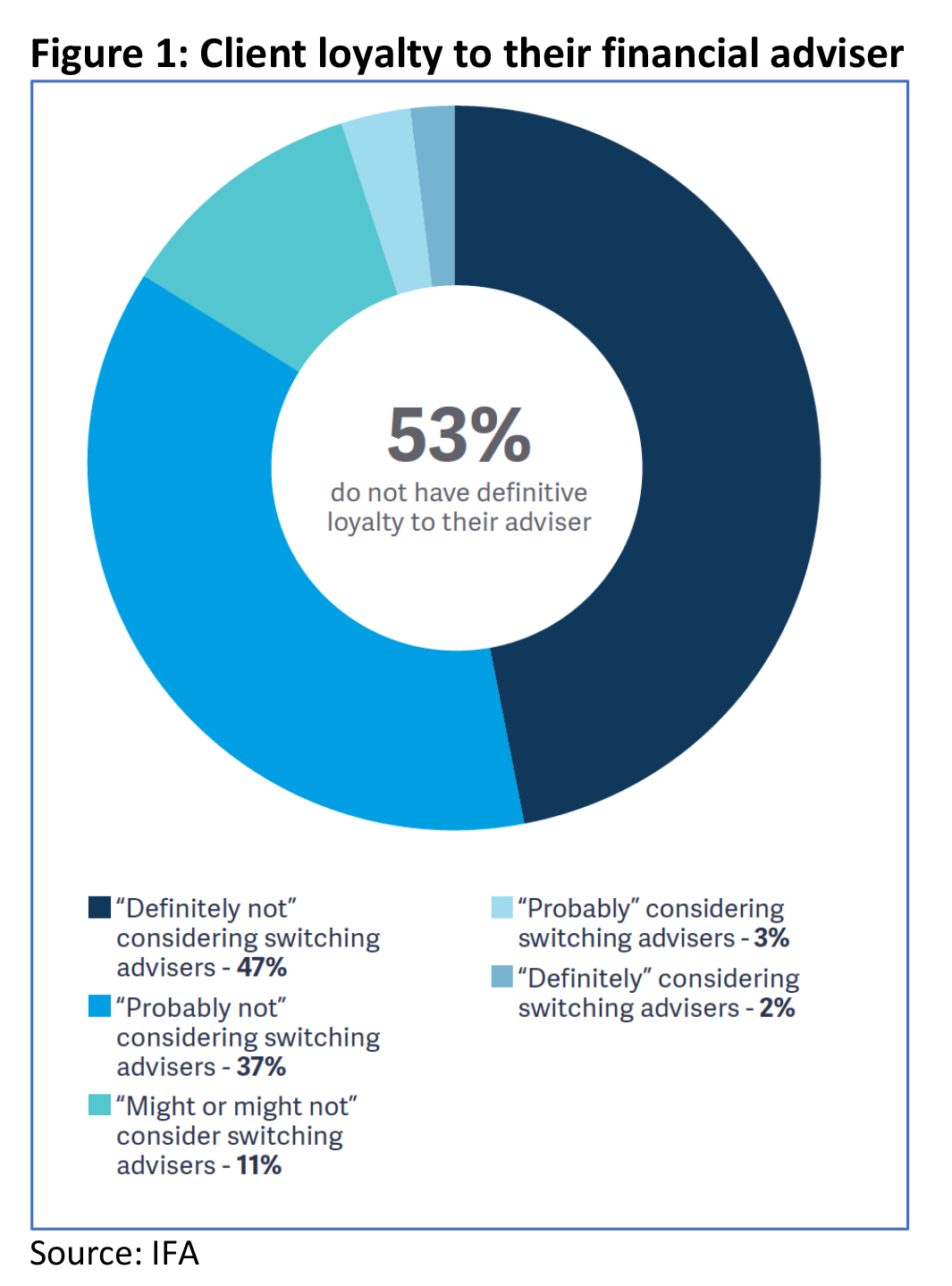

IFA research found that whilst client satisfaction levels with their advisers are high, loyalty isn’t widespread.

Ninety-four per cent of advice clients surveyed[4] said they were satisfied with their financial adviser. However, 53 per cent of advice clients said they don’t have a definitive loyalty to their adviser. There was also a weak link between greater rates of loyalty and longer relationships, with advice/client relationship greater than 10 years being surprisingly vulnerable.

The same study also found that around 50 per cent of advice clients don’t have total clarity on what their fees are paying for – hardly a recipe for a successful relationship.

Just as damaging can be drop-out rates – those clients who get part way through the onboarding process and just pull out in sheer frustration with the volume of touchpoints and paperwork. According to Adviser Ratings[5], around 50 per cent of potential clients drop out during the onboarding process if it’s a cold lead, and the average adviser loses 25 per cent if it’s a warm lead.

Even those who pay for comprehensive financial plans don’t necessarily go ahead with them. One US study found[6] that more than half the clients receiving a financial plan had only implemented 20% or less of the recommendations!

[1] https://assets.kpmg/content/dam/kpmg/pdf/2016/07/transforming-client-onboarding.pdf

[2] https://www.afr.com/companies/financial-services/100-000-quit-financial-advice-as-fees-jump-another-8pc-20220418-p5ae5t

[3] https://www.fidelity.com.au/insights/investment-articles/the-value-of-advice/

[4] https://www.ifa.com.au/news/27145-client-experience-survey-the-findings-revealed

[5] https://www.professionalplanner.com.au/2019/05/where-were-going-wrong-with-client-onboarding/

[6] https://www.fa-mag.com/news/where-formal-financial-plans-fail-52847.html?print