Measure it. Control it.

Management guru, Peter Drucker, made a valuable point when he famously said[1], “if you can’t measure it, you can’t manage it”, which helps explain why today, businesses of all sizes generally have a wealth of business metrics at their fingertips. Financial advice practices are no exception, and discussions about KPIs and dashboards are as common as those about stock market movements and legislative changes.

But while most advisers and practice owners will have a good handle on the top line and obvious metrics (revenue, profitability, conversion rates, attrition rates, cost to serve etc), a smaller group are ahead of the curve, focusing on client metrics which – despite being largely non-financial and sometimes ‘off Broadway’ – can be far more meaningful in terms of measuring how effectively the practice is delivering successful outcomes for its clients and, by extension, its long-term sustainability.

In this article we will take a look at the five key metrics, or rather categories of metrics, that forward-looking advisers are focusing on, along with the underlying methodology and practical measurement techniques for each.

Five categories to focus on

This article will focus on five categories of client metric we believe are critical to delivering great client outcomes on a sustainable basis.

- Client satisfaction and loyalty

- Client service delivery

- Website metrics

- Client engagement and communication metrics

- Client sustainability metrics

1. Client satisfaction and loyalty

Arguably, the most obvious and valuable client metrics are those relating to client satisfaction and client loyalty.

Indeed, Fred Reichheld – architect of the Net Promoter Score (NPS) methodology – argued the best predictor of top-line growth can usually be captured in a single survey question and a single number[2] (as explained below).

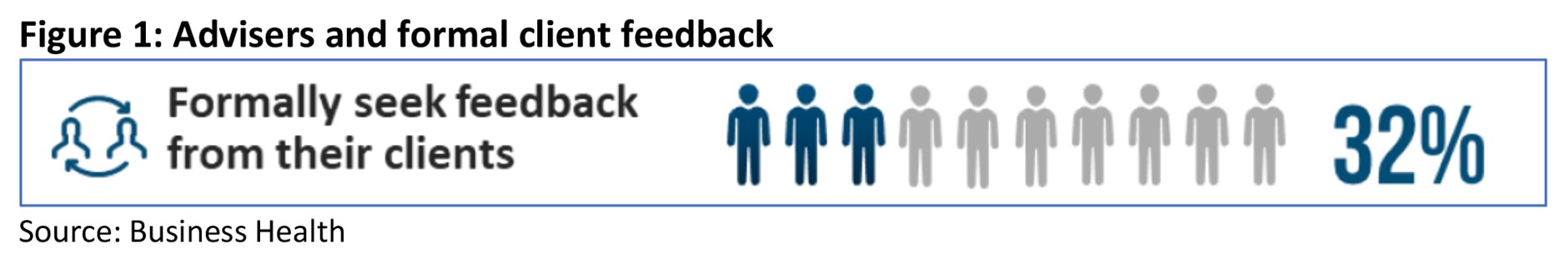

But despite this, and despite good intentions, Australian research suggests less that one third of advisers formally seek feedback from their clients[3].

NPS – the only number you need to grow

There are many methodologies that advisers can use to gauge how satisfied their clients are, including focus groups and surveys asking clients to rate certain attributes on a numerical scale (often out of 5 or 10).

Perhaps the most valuable metric however, which has been popular with large corporates and is now gaining traction with advisers and smaller businesses, is the Net Promoter Score (NPS) metric. Happily, this is also a very easy metric to capture, wrapped up as it is in the answer to one simple question:

“Would you recommend this company to a friend?” (On a scale of 1 to 10)

The worldwide phenomenon that is NPS was based on two years of research in which a variety of survey questions were tested by linking the responses with actual customer behaviour—purchasing patterns and referrals—and ultimately with company growth.

Surprisingly, the most effective question wasn’t about customer satisfaction or even loyalty per se, it was about willingness to talk up a company or product to friends, family and colleagues. In most of the industries studied, the percentage of customers enthusiastic enough about a company to refer it to a friend or colleague directly correlated with company growth rates.

This willingness to advocate for a company or product to friends, family and colleagues is seen to be one of the best indicators of loyalty because of the customer’s sacrifice in making the recommendation. When customers act as references, they put their own reputations on the line, and they will only take such a risk if they feel intense loyalty.

There is even science behind interpreting the scores given often reflecting cultural norms. In Australia, for example, scoring a brand 5 or 6 out of 10 is not a ‘pass mark’. It means we are unhappy but too polite to say so. People giving a score of 6 or less are likely to be detractors of your brand, meaning they will talk you down to their friends and colleagues. Giving a brand 7 or 8 is polite neutrality. Only those people scoring you 9 or 10 can be classed as ‘promoters’, or advocates for your brand.

To continue reading and receive CPD points, view he original article on AdviserVoice's website.

[1] https://blogs.worldbank.org/education/you-can-t-manage-what-you-don-t-measure#:~:text=But%20as%20the%20management%20guru,Or%20poorly%3F

[2] https://hbr.org/2003/12/the-one-number-you-need-to-grow

[3] https://www.businesshealth.com.au/future-ready-viii-extract-executive-summary-jan-2020/