The great wealth transfer – opportunity or threat?

The impending multi-trillion-dollar intergenerational wealth transfer, and its social, economic, and political consequences, has been a hot topic in the media for a few years now.

Naturally, it has also been a ‘front of mind’ issue for many financial advisers grappling with the implications of this shift of money – from their clients to their clients’ children – on longstanding relationships, and even on the future sustainability of their practice. With research suggesting that many Gen X and Millennial inheritors are likely to seek their own financial adviser rather than stick with the one used by their parents, the challenge to retain transferred wealth can indeed be a significant one.

For those advisers seeking to retain this wealth – by serving the next generation within a client family – understanding the motivations and mindset of younger clients is critical, as is a framework to facilitate more forward planning, transparency and communication between your clients and their heirs.

The nature of the challenge

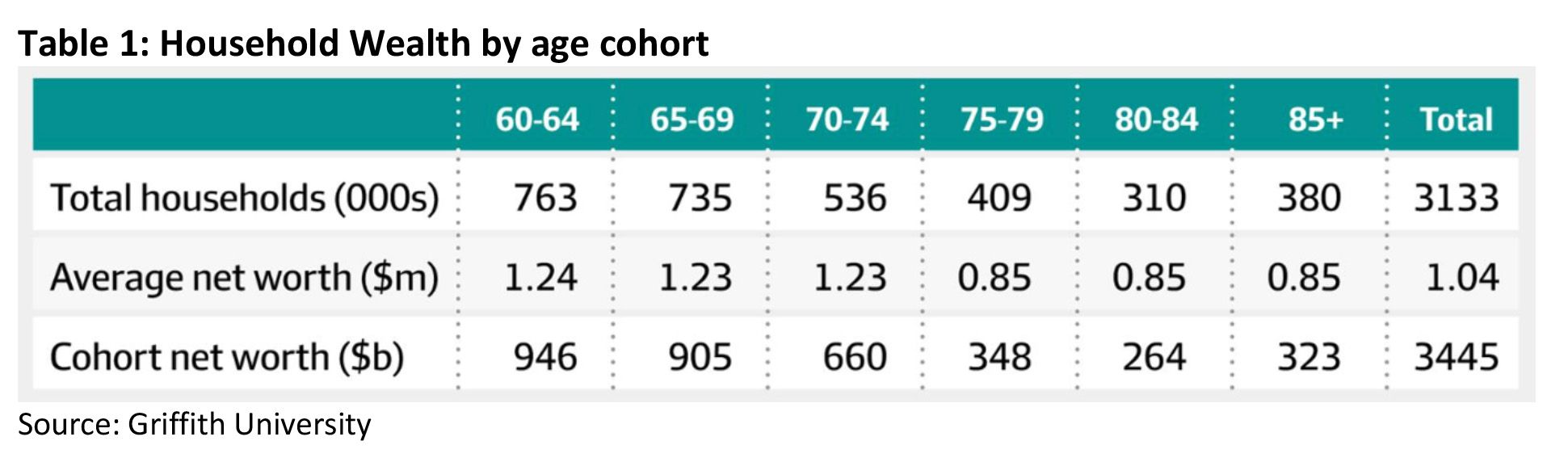

According to research by Griffith University[1], the amount of wealth that is ripe for transfer over the coming years is around $3.5 trillion. And while the majority of transfer is likely at least a decade away, as Table 1 below, shows, around half a trillion in wealth is currently sitting with individuals aged 80 or older, with transfer therefore imminent.

Experts estimate Gen Xers will inherit just over half (57%) of this wealth, with Millennials set to collect the bulk of the rest[2].

Advisers seeking to keep managing this transferred wealth can face an uphill battle to do so. This is partly because of the complex dynamics of parent-child relationships, and partly because of the different financial behaviours and attitudes that characterise younger clients.

Perhaps best summing up the scale of this challenge is US research[3] by Investment News, that found that 66% of children terminate the services of their parents’ financial adviser once they have inherited their wealth.

(As a quick exercise, what would the loss of two thirds of your baby boomer clients do for your practice – and your ability to keep serving your other clients?).

Research by Coredata[4] explored this topic in more detail with UK and US based advisers and found that even advisers themselves were pessimistic. When asked “What percentage of your primary clients’ heirs do you think will retain your services after your client passes away?”, US based advisers estimated just over half (57.1%), whereas UK advisers guessed a mere 41.7% of clients would stay.

So, what’s at play here?

The uncool parent phenomena

Certainly, one explanation can be found in the deep-seated psychology of parent-child relationships. In simple terms, it is normal for each generation to dismiss their elders as ‘uncool’. This characterisation extends from everything to the way our parents behave, to the music they listen to, and the products they buy. It also often extends to the professionals they use (who get thrown into the same bucket).

This almost innate tendency to regard our elders as ‘out of touch’ with contemporary society, coupled with our own need to forge our own identities independent of our parents, can be explained by basic psychological theory.

To continue reading and receive CPD points, view the original article on AdviserVoice’s website.

[1] https://www.afr.com/wealth/personal-finance/how-to-get-the-great-wealth-transfer-right-20191205-p53h7b

[2] https://nymag.com/intelligencer/2021/07/will-the-great-wealth-transfer-spark-a-millennial-civil-war.html

[3] https://www.investmentnews.com/the-great-wealth-transfer-is-coming-putting-advisers-at-risk-63303

[4] https://www.coredataresearch.com/downloads/reports/losing-legacies-report-2020.pdf