Bennelong Funds Management (BFM) is part of the Bangarra Group—a global organisation where business and philanthropy go hand in hand to drive lasting, positive change. As a multi-boutique investment firm, we partner with high-quality Australian and global fund managers, holding minority stakes and supporting distribution.

Our boutiques invest across a range of asset classes, including Australian equities, global listed infrastructure and real estate, emerging markets, and global small-to-mid caps. BFM also offers outsourced fiduciary services, acting as a responsible entity (RE) or trustee for new and established managers. Our broad AFSL allows us to deliver flexible, tailored solutions across a wide range of investment products.

Since 2006, we’ve helped investment managers grow, while delivering strong outcomes for investors across Australia and around the world.

Trustee services

As the responsible entity or trustee of a fund, Bennelong assumes full oversight and compliance responsibilities. We engage with service providers and stakeholders to ensure investor protection while optimising fund performance. Key aspects of our services include:

- Total fiduciary responsibility for the fund.

- Interaction with ASIC on all compliance and regulatory matters, reducing time and cost for investment managers.

- Enhanced independence through our established corporate governance infrastructure.

We also offer assistance with fund setup, leveraging our network of established relationships and service provider agreements for an efficient process.

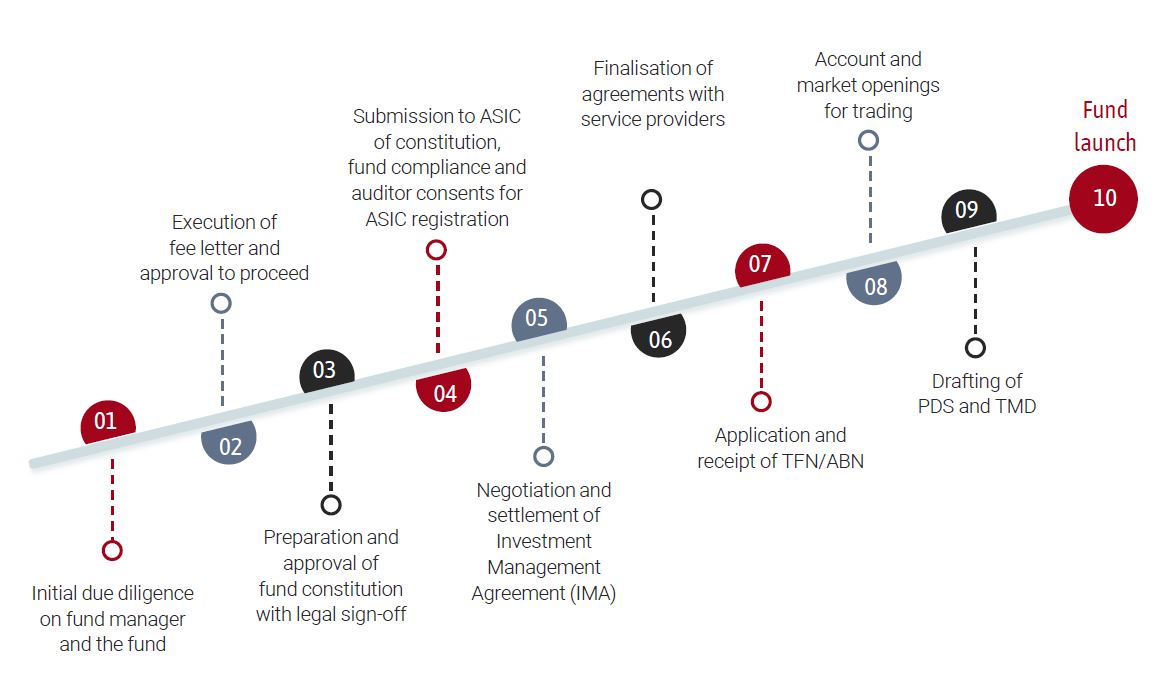

The set-up process

While the setup process can seem daunting at first, our experienced team is here to make it as smooth and stress-free as possible. We’ll guide you through each step, breaking things down clearly and handling the complexities behind the scenes—so the whole experience feels simple, straightforward, and well-supported from day one.

On-going interaction

- BFM will nominate a designated relationship manager contact who will act as the single point of contact between the fund manager and the BFML

- BFM will monitor

- (i) the fund managers adherence via provisions in the IMA and annual formal due diligence and;

- (ii) the service providers via various KPIs

- Annual Compliance Plan audit will audit processes and procedures of the RE in the compliance and regulation of the fund

- BFM will coordinate production of audited annual financial statements

- The initial set-up process will necessitate a weekly call with all parties until BFM the PDS is live in the market

Ancillary service

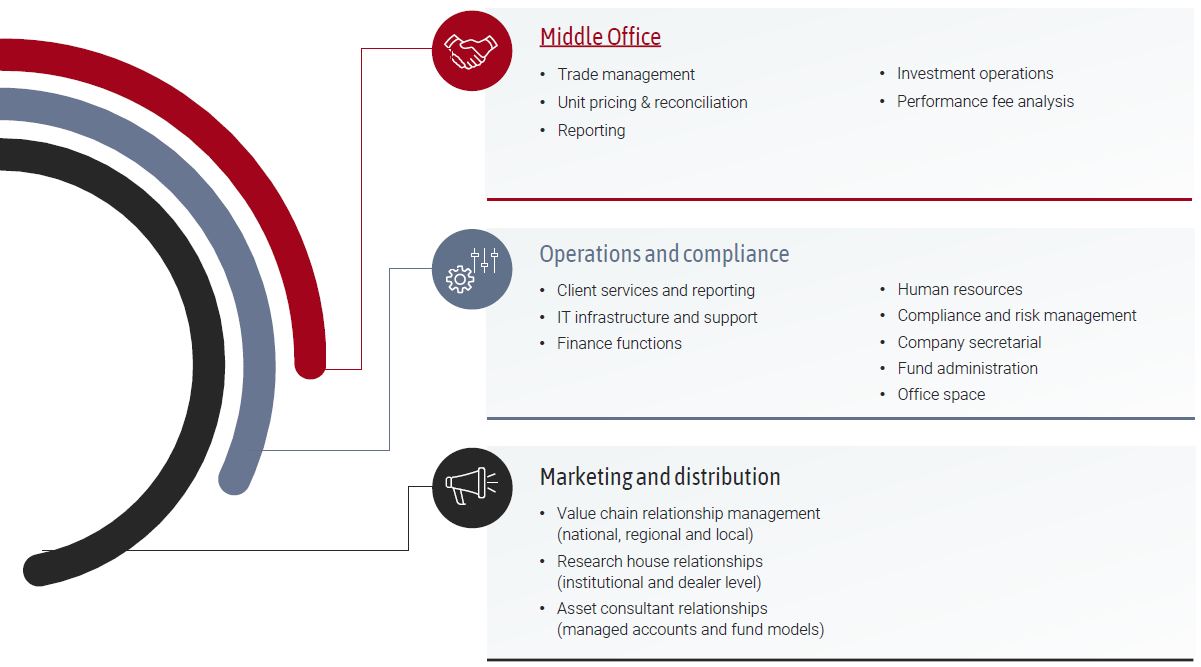

BFM can offer a host of ancillary services that complements the fiduciary role through a tailored middle-office offering.