Trust is the bedrock of successful financial planning relationships. The establishment of trust between an adviser and client has been proven to facilitate more open and comprehensive communication, allowing the advice to be more tailored, more effective, and more valued. Trust has also been shown to drive greater client satisfaction, loyalty, and practice sustainability.

And yet many advisers lack a systematic approach to building trust, believing it to be more of an outcome of behaviours that are intrinsic and therefore ‘come naturally’.

While it is true that trust is to be earned rather than asked for, contact between client and adviser is generally infrequent and sporadic, meaning that advisers need to take every opportunity they can to build and reinforce trust. The most effective and efficient way to do this is to systemise trust into every aspect of your business, meaning trust is reinforced not just through adviser behaviours, but also through the processes used throughout the practice.

Why trust is so important in financial advice

There is an extensive body of research into the nature and outcomes of trust in financial advice.

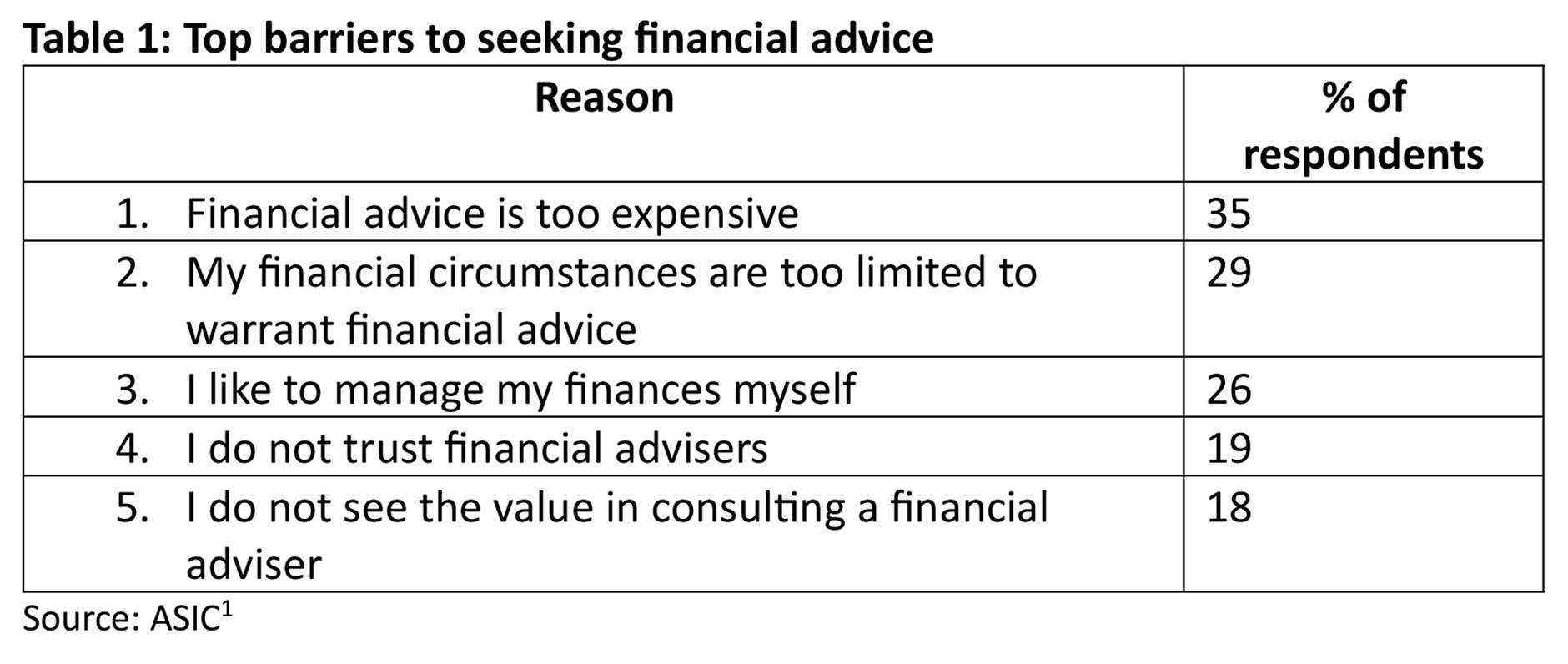

Similarly, there is also research which demonstrates the extent to which the lack of trust is a barrier to the uptake of advice.

ASIC’s REP 627, published in 2019, found that distrust of financial advisers was one of the top reasons for not seeking financial advice:

By contrast, research suggests that once a client engages an adviser, they become much more positive about the value of advice, and trust is a key driver of this.

A study of US advice clients[2] found that 81% gave their adviser a high trust rating, and that trust in an adviser was positively correlated with the client’s age, wealth, and tenure with the adviser.

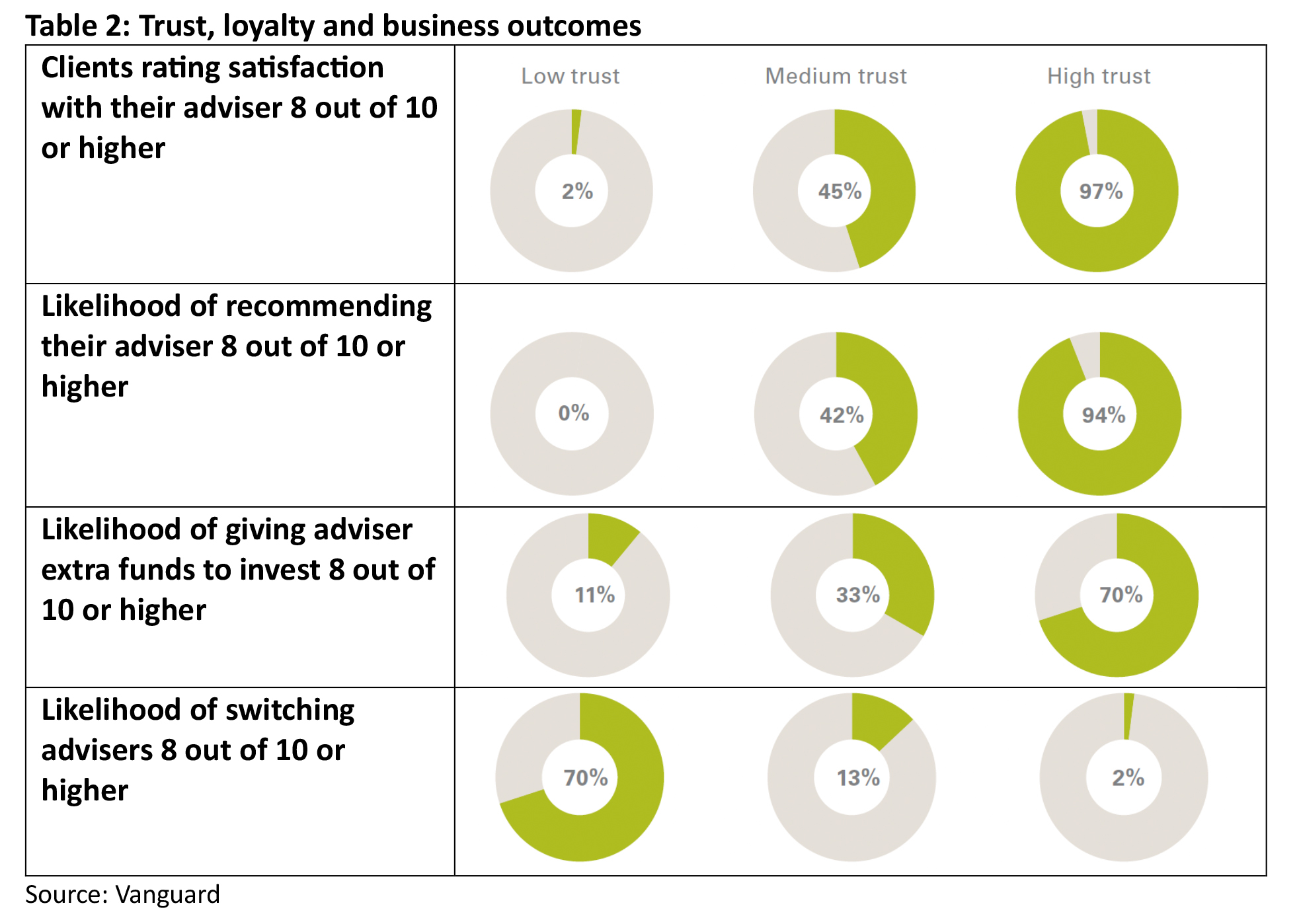

That same study also quantified the extent to which trust was a driver of client satisfaction, loyalty, share of wallet and likelihood to recommend:

The findings reinforced those of an earlier Australian study[3] – The Trusted Adviser – which concluded that trusted advisers:

- have higher client advocacy

- have better prospect conversion

- are more involved in their client’s personal and financial affairs

- deliver improved financial and outcomes and real value to their clients

- have higher client satisfaction

- have clients who are more accepting of, and willing to pay, advice fees

- run more profitable practices.

The drivers of trust

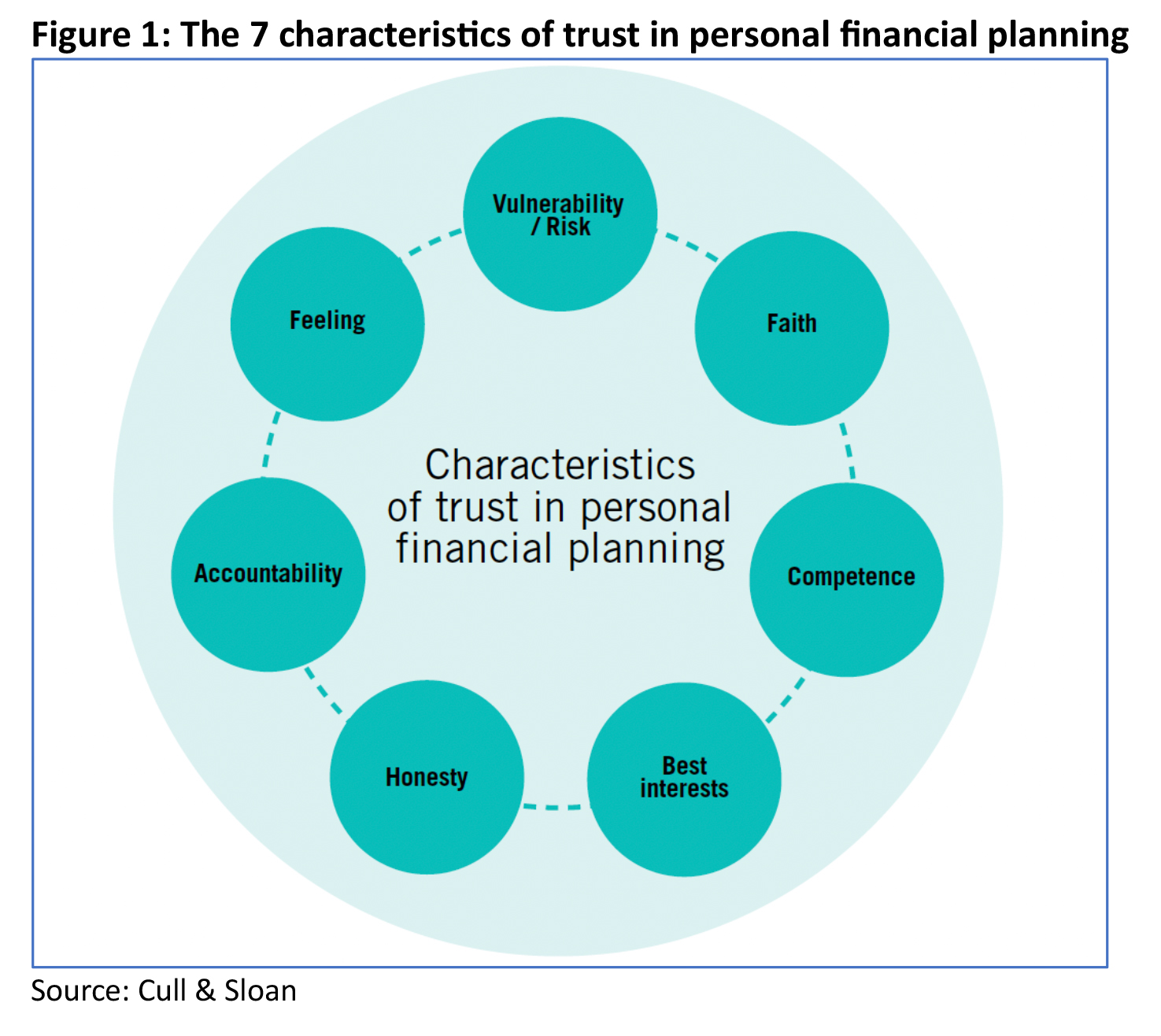

In order to build trust, it is important to understand what drives trust in a financial advice context. A University of Western Sydney research paper[4] published in the Financial Planning Research journal synthesised research from around the world, resulting in a framework comprising seven characteristics of trust:

Vulnerability/risk

In order for trust to exist, there must be an element of risk or vulnerability. This is clearly true in a financial advice context, where the client is placing their financial futures in the hands of someone they may never have met before. The client can be vulnerable on a number of levels:

- they may be entrusting the investment of their life savings to the adviser

- they likely lack the knowledge and experience by which to assess the competence of the adviser and the efficacy of the advice

- the need for advice may be triggered by circumstances which leave them emotionally and financially vulnerable, such as retirement, divorce, or the death of a loved one.

Feeling

Trust in personal financial planning was found to have a large affective component – described as ‘a feeling’. In other words, trustworthiness is something that we are able to detect on a deep emotional and physical level. We all give off verbal and non-verbal cues that are indicative of our trustworthiness, and given the high financial stakes involved in an advice relationship, clients will generally increase their focus on detecting and interpreting these cues.

[1] https://download.asic.gov.au/media/5243978/rep627-published-26-august-2019.pdf

[2] https://static.vgcontent.info/crp/intl/auw/docs/resources/adviser/Vanguard_research_Trust_and_financial_advice.pdf?20190930%7C173924

[3] https://www.afa.asn.au/wp-content/uploads/The-Trusted-Adviser.pdf

[4] https://www.griffith.edu.au/__data/assets/pdf_file/0018/205713/FPRJ-V2-ISS1-pp12-35-characteristics-of-trust-in-personal-financial-planning.pdf