No study of emerging trends in financial services – and indeed financial advice – would be complete unless it examined the growing importance of RegTech.

Regulatory Technology (RegTech) refers to the use of technology to achieve regulatory objectives. This can include its use by businesses to manage regulatory compliance, and by governments to manage oversight, benefiting consumers, companies and regulators. Whilst in its broadest sense RegTech is sector agnostic, its adoption has been especially strong in the financial services industry, where regulatory complexity and the massive scale of customer data and interactions make its benefits more obvious.

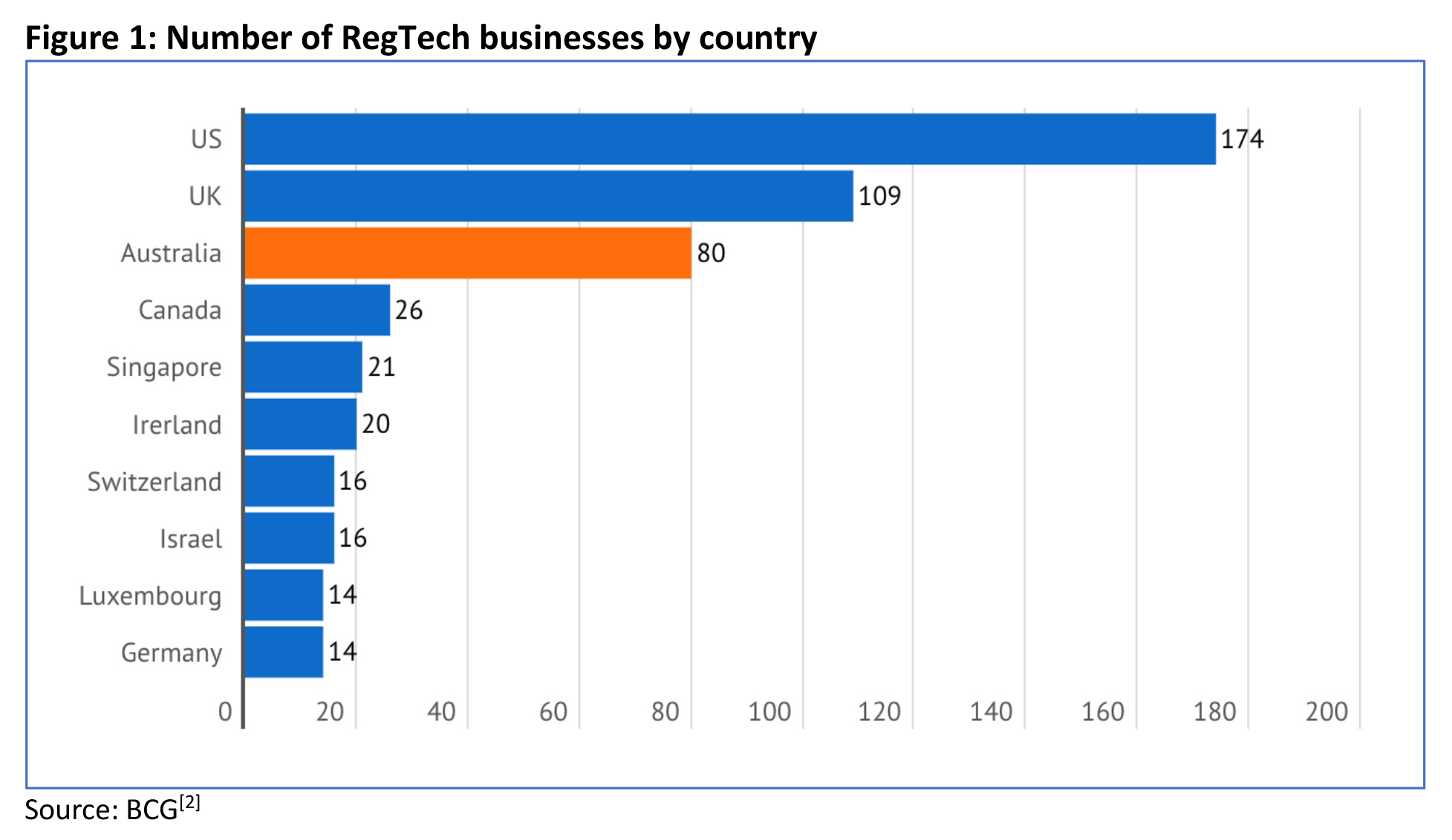

RegTech is a rapidly growing sector, valued at over USD $15 billion globally and expected to grow to nearly $90 billion by the year 2028[1]. Australia is at the forefront of RegTech, both in terms of usage and the scale of innovation, with our 80 locally headquartered RegTech firms putting Australia behind only the UK and USA as a Regtech hub[2].

Analysis[3] of Australian bank financial results in 2021 revealed that close to 50% of all investment spend was on regulatory and compliance activities, and, unsurprisingly, much of the investment in Regtech to date has been driven by larger firms[4] using RegTech to help in areas including Anti Money Laundering, cybersecurity, and customer data protection.

But, increasingly, RegTech solutions, in both ‘low tech’ and high tech’ forms are being adopted by small and medium firms in the financial advice sector, as more accessible solutions continue to come to market, either as new standalone offerings, or as enhancements to popular and established platforms.

And, as a glimpse of the financial news proves, Licensees and individual financial advisers are increasingly starting to realise the potential for Regtech to improve the accuracy and efficiency of their compliance, and thus contribute positively to both their client experience and their overall sustainability.

Advisers – and consumers – have a headache

A 2019 survey of FPA members[5] revealed the escalating costs of compliance to be advisers’ number one challenge. A year later, in the darkest days of COVID-19, an ongoing study by Investment Trends found that the compliance burden was still their number one business challenge, cited by 68% of advisers, ahead of the 59% who nominated ‘Disruption from COVID-19’ as their main challenge[6].

These concerns translate directly into an issue for the 2 million[7] or so consumers currently seeking advice, as the rapidly increasing cost of providing advice puts it out of reach to all but the well-off. Combined with the continuing decline in the supply of advice – adviser numbers have shrunk by 40% since 2018 – we see a significant, and growing, advice gap.

In simple terms, one of the most powerful pillars of consumer protection is being eroded daily.

Technology is the solution advisers can control

While there is clear scope for regulatory reform to play a role here – the FSC estimating[8] that the time and cost to produce advice could be slashed by a third with the right changes – it would be foolhardy to pin too much hope on meaningful change happening any time soon.

What advisers can control is their own approach to the existing regulatory framework, and here technology can play a crucial role in driving improved efficiency, compliance and client outcomes. Happily, this is a point acknowledged by Australian advisers. ASIC has found widespread adviser acknowledgement of the benefits of technology in its regular industry consultations[9]. Respondents to a 2019 survey by Netwealth nominated RegTech, Artificial Intelligence and machine learning as the technologies that would have the greatest impact on financial advice practices over the coming 5 years[10].

Importantly, the reshaping of the advice licensing landscape, from large institutionally owned licensees to more boutiques and self-licensed practices, creates the conditions for more rapid RegTech adoption, as advisers are no longer dependent on their institutional owners – and their lengthy procurement processes – to make technology purchase decisions.

Advisers are now, more than ever, empowered to make their own technology choices, enabling them to implement preferred solutions into their business, faster.

To continue reading and receive CPD points, view this article on AdviserVoice’s website and complete the questionnaire.

[1] https://www.prnewswire.com/news-releases/regtech-market-size-worth–87-17-billion-globally-by-2028-at-23-92-cagr-verified-market-research-301497770.html

[2] https://www.afr.com/companies/financial-services/australia-in-a-strong-position-on-regtech-20210615-p581ad

[3]https://home.kpmg/au/en/home/insights/2021/11/major-australian-banks-full-year-2021/potential-of-regtech.html

[4] https://www.pc.gov.au/research/completed/regulatory-technology

[5] https://www.moneyandlife.com.au/professionals/insight/regtech-improving-advice-efficiency/

[6] https://www.professionalplanner.com.au/2020/04/covid-19-the-second-biggest-challenge-for-advisers-in-2020/

[7] Ibid.

[8] https://www.moneymanagement.com.au/features/expert-analysis/using-technology-reduce-advice-hours

[9] https://www.professionalplanner.com.au/2021/04/advisers-have-no-appetite-for-digital-advice-asic/

[10] https://www.ifa.com.au/news/26725-ai-to-impact-all-aspects-of-advice-report