In an earlier article in this series, we discussed client segmentation, examining the many different ways segmenting clients and target markets can improve client engagement, efficiency, and practice profitability.

In this article, we commence a deeper exploration of specific client segments, shining a spotlight on Millennials (also known as Gen Y). Still considered by many advisers a fringe market for advice, due to their age and lack of assets, the Millennial generation has grown up fast, and is actively seeking expert financial help with their financial affairs. Beneficiaries of the $3 trillion intergenerational wealth transfer[1] that will take place in Australia over the next two decades, Millennials are not just the advice clients of the future, they hold the keys to building sustainable, fee-based financial advice businesses right now.

Meet the Millennials

So just who are the Millennials?

Whilst a brief online search reveals many different definitions, most are similar to that used by McCrindle Research[2], which sees the oldest Millennials having just turned 40:

According to McCrindle[3], there are over 5 million Millennials (or Gen Y) in Australia, meaning they outnumber both Gen X and Gen Z. By 2025 they are expected to represent a third of the workforce, which would again see them outnumbering Gen X (28% of the workforce), and Gen Z (31%).

Rather than being the focus of the future, Millennials already make up around a third of all consumer spending[4], making them a segment that companies across all sectors need to take notice of, immediately.

Most of us have seen/heard the Millennial stereotypes: they are lazy, expect to be promoted quickly, need constant praise (too many ‘achievement’ awards in school), spend all their time on social media, and still live at home.

Some financial advisers, too, have been guilty of pigeonholing them, deciding they don’t fit the traditional orthodoxy of needing or wanting advice because they are too young, and don’t yet have the assets or complexity of situation to warrant expert help.

But is any of this actually true?

Meaningful stereotypes

Focussing on insights of more practical value, it is possible to identify several characteristics shared by Millennials which reflect the world into which they were born.

- Tech savvy: the first generation to be digital natives, shaped by the internet and mobile technology.

- Social media smarts: Smartphones and social media feeds have become the chief information source for Millennials, and the way they consume products and services.

- Cause motivated: At work and in their personal lives, Millennials are heavily driven by the causes they support, and they are at the forefront of issues including climate change, sweatshop labour, and diversity & inclusion.

- Value experiences: Forgoing the suburban dream of their parents, many are living in the city, choosing travel and other experiences over mortgages and car loans. They are the first generation to embrace the concept of work/life balance.

Millennial money behaviours

Their money behaviours also differentiate them from older generations.

Credit

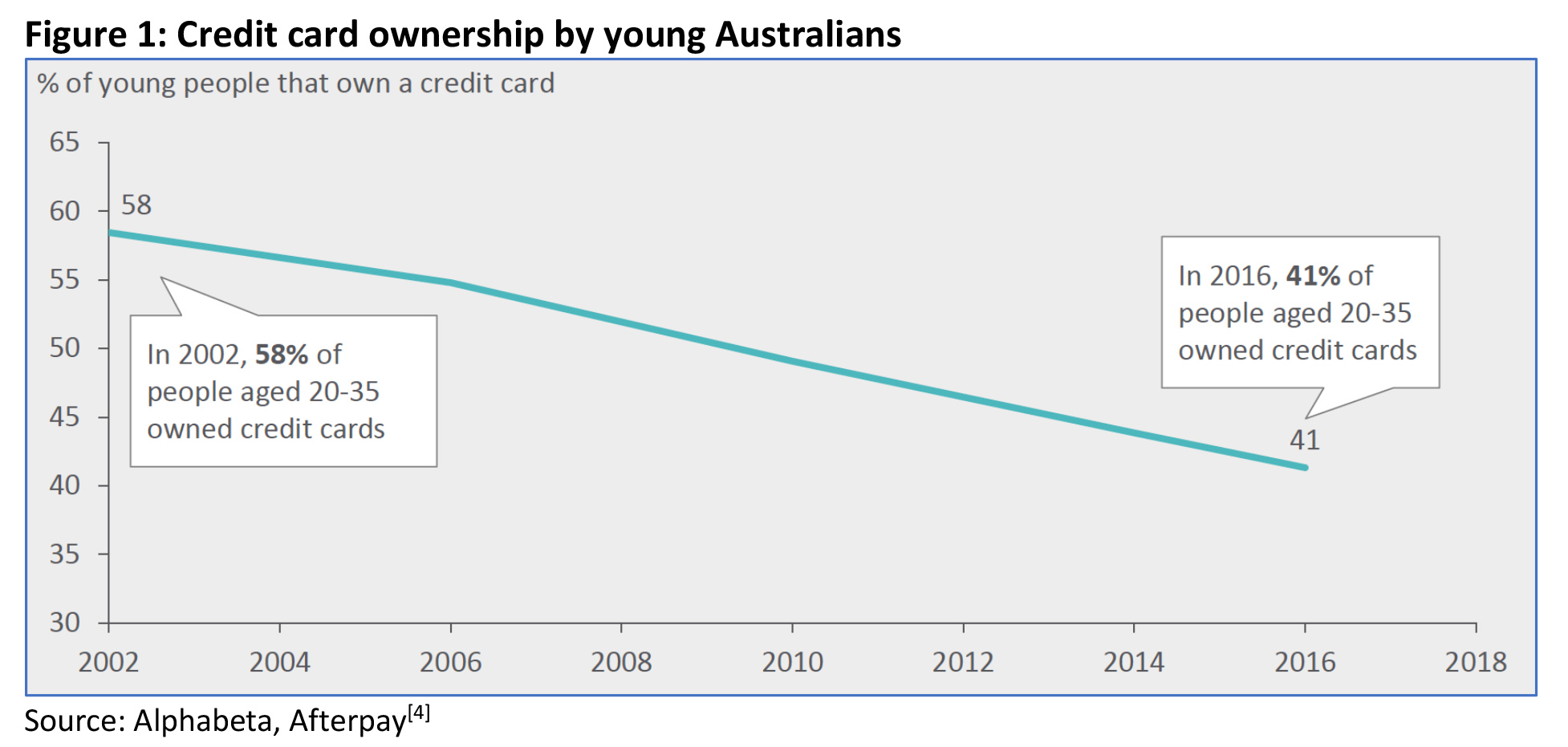

Millennials have a different attitude to credit than their parents, being 37% less likely to own a credit card (by choice) and holding lower debt levels as a proportion of income (10% of income vs 19% for older Australians).

Property

Probably the most significant financial challenge facing Millennials is that of home ownership. Driven by runaway demand for real estate, which not even a pandemic could dampen, rising property prices are making it harder for younger people to get a foothold on the property ladder.

Despite nearly 1 in 3 Millennials being university educated[5] (compared to 1 in 4 Gen X), and starting to enter their earnings prime, only 30% of Millennials own their own property, compared to 54% of Gen Xers and 68% of Baby Boomers[6].

Far from giving up on home ownership, one survey[7] found close to 80% of Millennials still aspire to ‘the Great Aussie Dream’ and are prepared to make major sacrifices to achieve this goal. More than half those polled said they would sacrifice little luxuries, experiences, and big-ticket items to make it happen and more than one quarter said they would even put off having children to afford their own home.

There are several implications of this reality.

Firstly, if you are a parent of Millennial children, the bad news is around a third expect to be living at home until they are 30[8].

Secondly, it means we have a whole generation desperately trying to amass the funds required for their first deposit. And with continuing low interest rates conspiring against the traditional savings path, more and more Millennials are turning to the stock market to accelerate their wealth.

To continue reading and receive CPD points, view this article on AdviserVoice’s website and complete the questionnaire.

[1] https://www.theguardian.com/bank-australia-people-australia-needs/2021/mar/18/three-trillion-reasons-millennials-are-set-to-drive-the-clean-money-revolution

[2] https://mccrindle.com.au/insights/blogarchive/australias-population-map-and-generational-profile-update/

[3] Ibid

[4] https://www.aph.gov.au/DocumentStore.ashx?id=185d5f3a-88fb-455e-b939-36daf31e66a7

[5] https://mccrindle.com.au/insights/blogarchive/australias-population-map-and-generational-profile-update/

[6] https://www.reinsw.com.au/web/posts/latest_news/2019/10._October/Millennials_and_home_ownership.aspx

[7] https://www.bankwest.com.au/about-us/media-centre/news/hold-the-smashed-avo-young-aussies-are-dreaming-big

[8] https://www.abc.net.au/news/2019-09-28/disenfranchised-millennials-property-ownership-unaffordable/11555420