Mind the (implementation) gap

In a financial advice context, the gap between client intentions and action is nothing new.

In a macro sense, we see this gap play out before people even get through the door of an adviser’s office. ASIC research[1] from 2019, for example, found that 20% of those intending to seek financial advice in the coming year never acted on that intention. Another study[2] posited that the unfolding multi-trillion-dollar intergenerational wealth transfer could come unstuck because of inertia. (80% of respondents intended to transfer their wealth but less than half had actually put a plan in place to do so.)

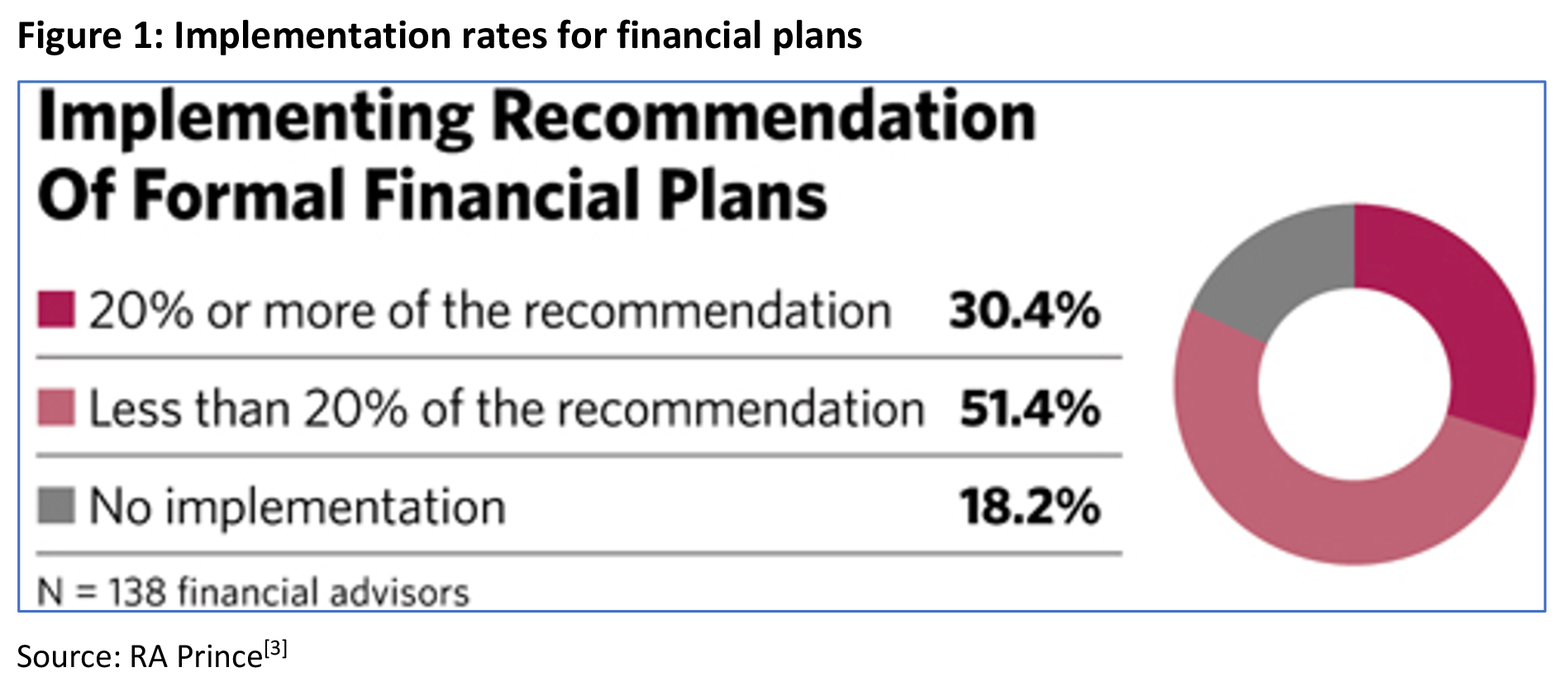

Even more perplexing are those clients who actually meet an adviser and pay for their advice, but then fail to implement it. Whilst there are undoubtedly advisers who boast a 100% success rate on this front, a survey[3] of advisers from the US – which found that more than half of clients receiving a financial plan implemented less than 20% of the recommendations 6 months after receiving the plan – is likely to be instructive.

So, what could cause such a gap? Surely, if someone goes to the trouble of seeking out – and paying for – financial advice, they should be prepared to act on that advice?

There are a few ways we could look at this conundrum.

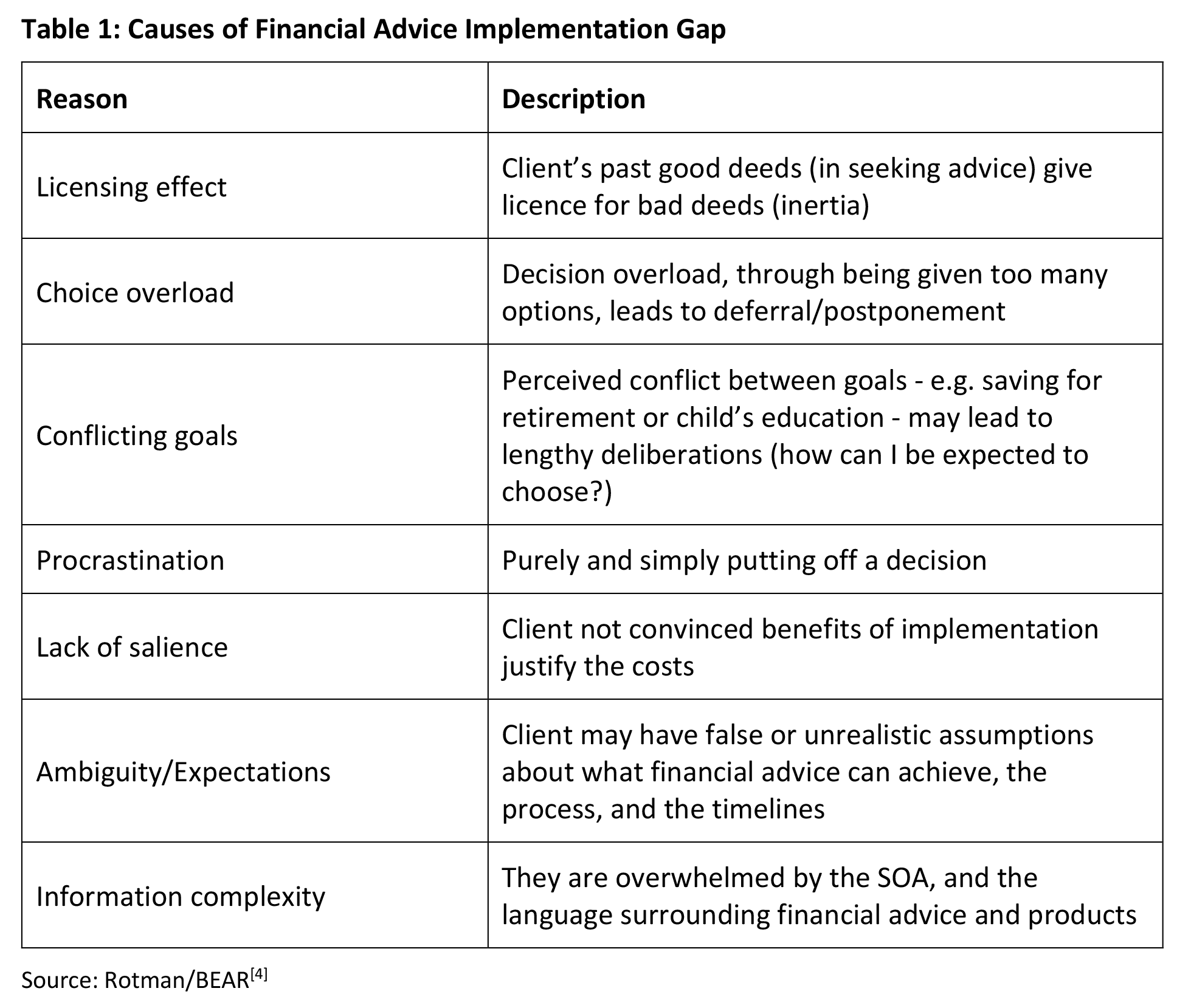

A Canadian study[4] from 2019, ‘Why Do People Fail to Act on Financial Plans?’, identified seven possible reasons for the implementation gap in financial advice:

The same study proposes a variety of techniques to mitigate these barriers to action, including:

-

breaking down advice and goals into smaller, easier to manage pieces (an incremental approach)

-

the regular and highly visual reporting of progress; and

-

simplification of documentation and language used

But are people seeking advice actually ready to change?

As valuable as the Rotman/BEAR research is, its starting assumption is that people seeking advice are actually ready to make the behavioural changes inherent in the advice. This may not actually be the case, which is a why a different perspective may be more helpful.

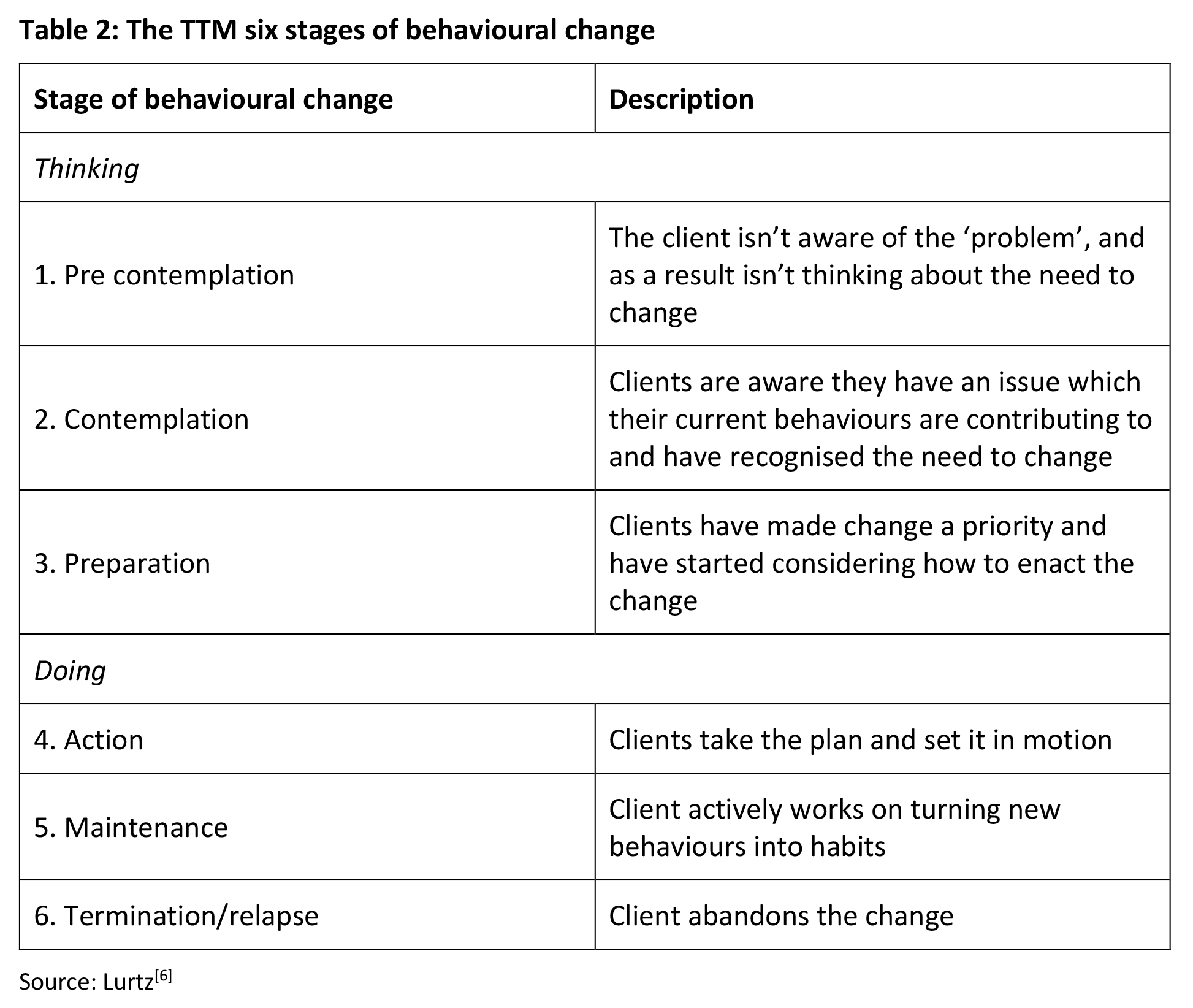

The 6 stage Process of Change[5], developed in the 1990s by researchers James Prochaska, John Norcross, and Carlo DiClemente, identified 6 steps to behavioural change.

These steps involve 3 ‘thinking’ stages and 3 ‘doing’ stages, as shown in Table 2 below:

One of the most immediate – and important – take outs from this model, called the Transtheoretical Model (TTM) of Change, is that the assumption that people seeking advice are ready to act on it, is in fact false. In many cases, the client may have not even have recognised there was a problem needing change! (An example of how this can happen is when a client comes to see you at the insistence of their spouse.)

According to Prochaska et al, around 80% of clients sit in the first three – thinking – stages[7], a finding highly consistent with the alarmingly low implementation rates referred to in Figure 1 above.

To move clients through the stages, we need to identify the stage they are in

According to experts, clients can be stuck in the ‘thinking’ stages for as long as a year. Indeed, they can spend 6 months or more purely in the Pre-Contemplation stage! And for advice businesses, that means closing the intention/action gap is likely to be a strategic priority.

But in order to help clients move between all the different stages – which needs to be in sequence if the change is going to be sustainable – advisers first need to understand what stage the client is actually in.

Sometimes this is easy to identify. In our example mentioned above, the client has only agreed to seek out advice at the insistence of their spouse. In such circumstances, it is not unusual for the client to be in denial, believing they have no need to see an adviser. You will probably be able to spot this client’s verbal and body language a mile away.

But in other cases, it will be less obvious.

To continue reading and receive CPD points, view this article on AdviserVoice’s website and complete the questionnaire.

[1] https://asic.gov.au/regulatory-resources/find-a-document/reports/rep-627-financial-advice-what-consumers-really-think/

[2] http://www.fsadvice.com.au/media/library/FS_Advice/FS_Advice_-_Roadmap_for_a_new_landscape_-_SSGA.pdf

[3] https://www.fa-mag.com/news/where-formal-financial-plans-fail-52847.html?print

[4] https://www.rotman.utoronto.ca/-/media/Files/Programs-and-Areas/BEAR/White-Papers/BEAR-FinancialPlanning-1.pdf?la=en&hash=A727DC8970B87F39ABF418F5FA08B59B6FAE85F4

[5] https://www.prochange.com/transtheoretical-model-of-behavior-change

[6] https://www.kitces.com/blog/stages-change-james-proschaka-implement-recommendations-take-action-sustain-transtheoretical-model/

[7] Ibid