As trade tensions remain ongoing, and with most central banks clearly on an ‘easing bias’, we’re also asked for our views on the macroeconomic environment. Specifically, the prospects of a recession – both here (Australia) and more particularly in the United States.

Our response is generally the same. We know two things for certain.

There will be a recession in the US and elsewhere, and

We will have very little idea when it comes.

Knowing this, and armed with a mandate to preserve capital, means that on balance our portfolio will generally be defensive in nature.

What does defensive mean in a real estate context?

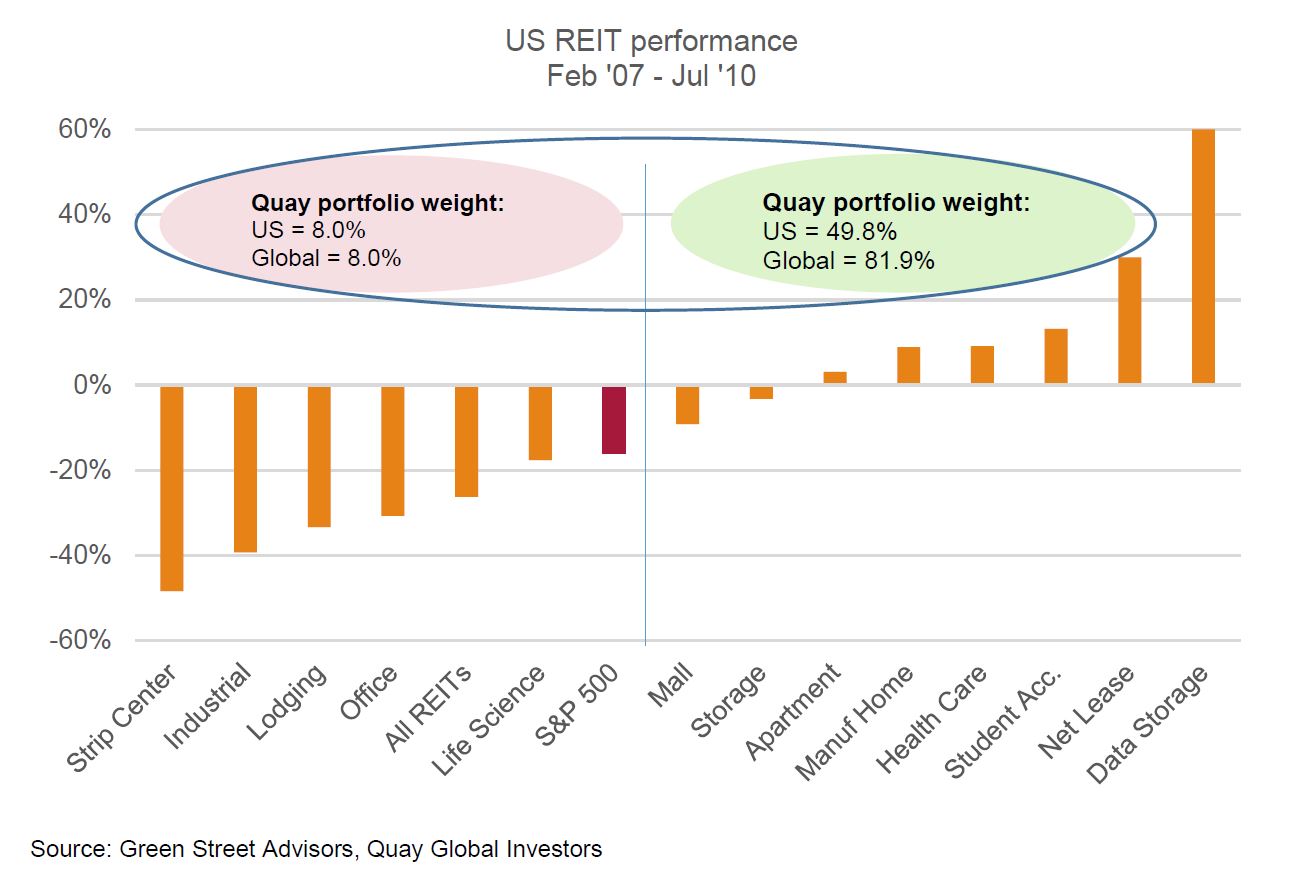

We recently came across an interesting chart from Green Street Advisors, analysing the sub-sector performance of US real estate asset classes during the past recession (the timeframes used began at the near peak and included the recapitalisations in 2009 and 2010).

We overlaid the chart with Quay’s current portfolio positioning (US weights and global weights), and separated these weights by sectors that outperformed the S&P 500 as a measure of ‘defensive’.

It is clear not all real estate performs equally during recessions.

We find the above chart interesting given the current narrative in Australian REITs suggests industrial and office are ‘safe havens’ – especially since neither sector is associated with the word ‘retail’. But the fact is, these sectors are economically sensitive to the real estate cycle. For example, a 1% move in the unemployment rate in Australia is the loss of roughly 120,000 jobs. And the loss of just 5,000 office workers is the equivalent of a large-scale empty office tower (think Grosvenor Place in Sydney, or 120 Collins Street in Melbourne).

Of course, past performance is no guarantee of future performance. There is a case to be made that next cycle, retail property may perform worse and industrial property better given the structural change occurring in both sectors. Having said that, the starting point of expectations for both sectors probably already reflects these issues.

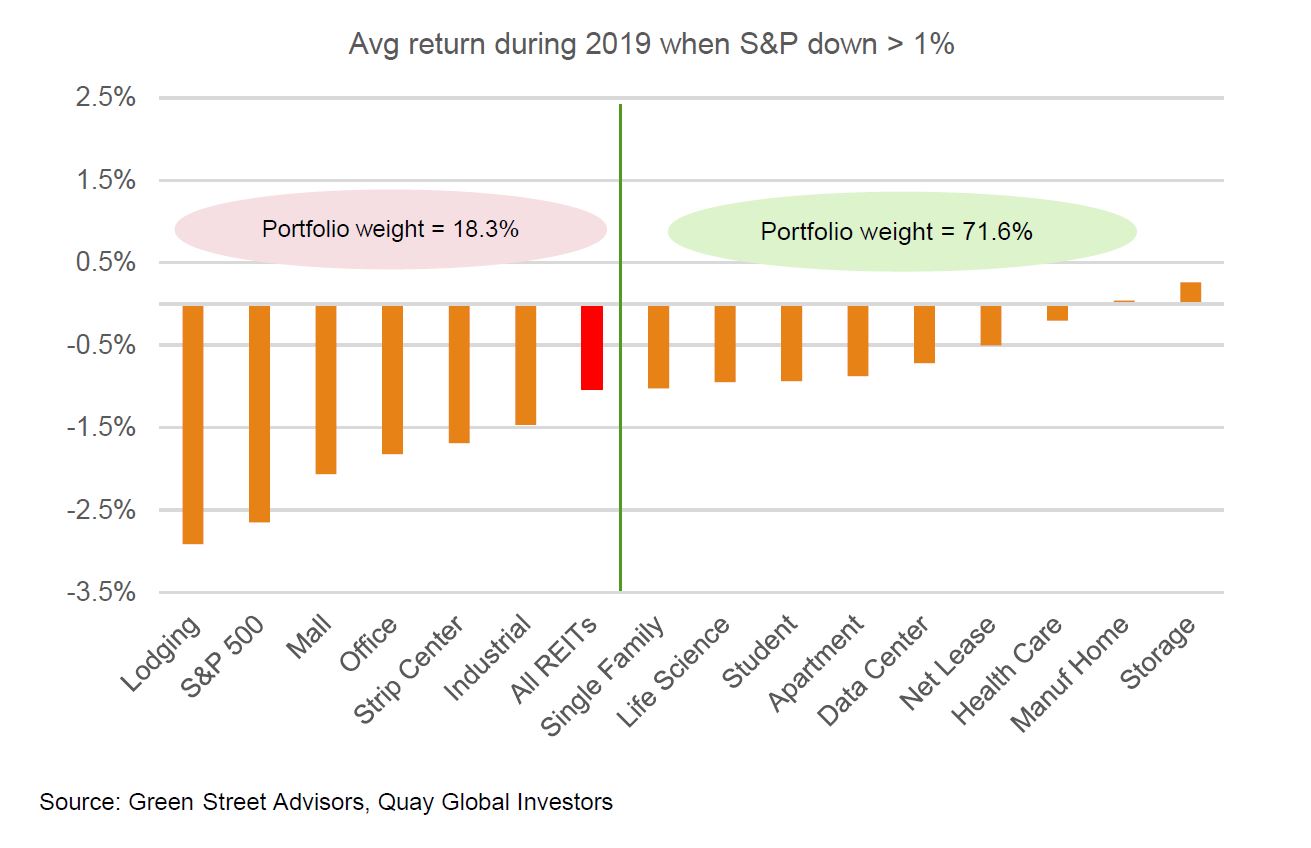

To take this analysis one step further, we looked at the performance of the sub-sectors during periods where the S&P500 declined more than 1% during 2019 (which usually reflected some pre-recession jitters). Interestingly, the data is broadly consistent with the 2007-2010 experience. Lodging, office and industrial all perform poorly while health, student accommodation and storage hold up well. On this occasion, though, malls performed poorly too.

Based on historic data, our portfolio is well positioned for an economic downturn – although portfolio construction is not done based on the fear of another recession. Indeed, our preferred sectors are based on long-term secular trends that support underlying tenant demand – which is probably why these sectors do well in recessions (or during periods of recession fear).

The role of leverage in a downturn

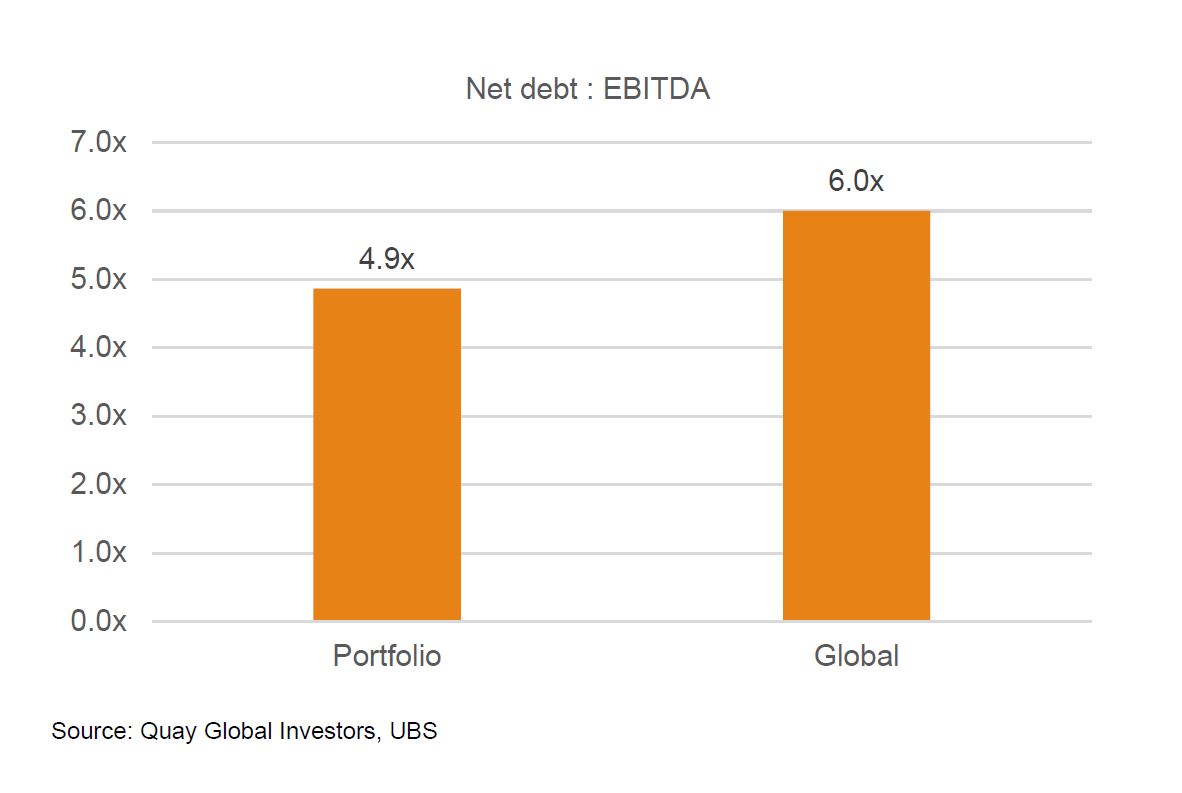

Another aspect that will have a meaningful impact on subsector performance is leverage. Here, too, we remain conservative in our approach.

There are many ways to measure leverage. In Australia, the most common is loan-to-value (LVR), although this approach has some significant shortcomings – notably the quality of the “V”. Our philosophy on leverage is that it is safer to have an LVR of 50% where value is half replacement cost, than an LVR of 30% where values are double replacement cost. In that context, investors should be wary of low LVRs across well-bid sectors such as office and industrial property in the current cycle.

Another leverage measure is net debt to EBITDA. In essence, this ratio broadly reflects how many years of pre-depreciation cashflow covers net debt. It measures leverage against the earnings capacity of the underlying assets, rather than the market value of those assets. While this is not a perfect measure, taken with other metrics such as debt / historic cost, interest cover and loan to replacement cost, our portfolio screens well relative to the global developed universe.

How does this affect Quay’s investment process?

We’re not embarrassed to say we don’t have the expertise or tools to accurately predict the onset of the next recession (local or global). However, we believe the business and real estate cycle is not dead, and an economic downturn is inevitable. Whether that is based on current trade tensions and emerging geopolitical risks, or some other ‘tail’ event, remains to be seen.

Ultimately, we see ourselves in the business of wealth preservation. This means we will naturally skew our portfolio to what we believe to be lower risk assets with low leverage within the real estate landscape. That may mean there are times we will miss some of the upside. That’s okay – as long as we do our best to protect against the downside while achieving our total return objective through the cycle.

Download a copy of the article here.