Last month we published our take on one of the biggest economic discussions today – Modern Monetary Theory (MMT).

Most of the public debate to date has centred around the role of government: that is, deficits, the causes of inflation, and implications for public policy. As we stated last month, however, MMT is extremely detailed and has a deep history that extends well beyond role of government.

MMT is a stock-flow consistent view of the economy

One of the disciplines MMT literature fosters is to frame most economic discussions in a ‘stock-flow consistent’ manner. What does that mean?

When it comes to the stock market, how many times have we read of “a lot of money sitting on the sidelines”? The reality is there is always money sitting on the sidelines; whenever a share is bought on the ASX or NYSE, it is simultaneously sold. That is, the amount of money going into the stock market is exactly equal to the amount coming out. The stock of money on the sidelines is unchanged.

What about “China is funding the US Government deficit”? If you read last month’s Investment Perspectives, you’ll now know this to be false. For any country or foreign entity to buy US bonds it must first acquire US dollars – and we know USD are issued only in the USA. US dollars do not flow from China to the USA, but are already in existence in the USA to begin with. That is, the stock of US dollars is independent to the foreign percentage ownership of US bonds. China – or any other country – does not fund the USA.

A stock-flow consistent understanding is important when viewing the non-government sector via the MMT lens.

MMT, the private sector, and endogenous money

One of the central understandings of MMT within the private sector is to understand how money is created.

Most mainstream economists believe in the ‘loanable funds’ model. That is, banks must first get funding (deposits) before they can lend. Below is a nice summary of mainstream thinking:

"A higher savings rate increases the supply of loanable funds that banks can lend out, therefore decreasing interest rates." – St Louis Fed

In Australia, we are often told our banks must get offshore funding to make loans to local businesses and households.

This is false. Australia does not require any external funding for banks to make loans.

In reality, the loan creates the deposit.

For example, when a customer applies for a loan to buy a house, the bank creates two accounts for the customer on approval – a loan account and deposit account. Upon drawdown of the loan (settlement of the house), the loan account and deposit account are simultaneously credited via double entry bookkeeping. The new money is literally nothing more than computer keystrokes.

When the money in the deposit account is used to acquire the home, the seller receives the deposit and the loan stays with the buyer. In this way the banking system is always funded.

No foreign institutions required.

No issuing new bonds to fund new mortgages.

Moreover, the newly created deposit may move from bank to bank as the money is spent on goods and services, but it never leaves the banking system. The floating currency (e.g. the Australian dollar) ensures that for every seller of the currency (deposit) there is a buyer – the stock of Australian dollars does not change with respect to foreign investors (like the stock exchange example above).

The deposit is eventually extinguished when either:

- The money is used to extinguish an existing loan, or

- Taxes are paid.

While the idea of endogenous money was somewhat controversial some years back, the idea is becoming more accepted. Indeed, the Bank of England wrote an excellent paper on the topic here, and more recently a very good interview on the credit process can be found here.

Implications of endogenous money

I first accepted this idea in my early readings of MMT back in 2009. At the time I was a real estate banker and had been involved in many very large commercial loans for many companies. My observation was that these loans were only limited by the approval process – not the funding process. That is, once a loan was approved, funding was never a problem. It was only later with MMT that I understood the loan created the funding.

This raises several obvious questions. If banks are not constrained by funding, how can they go broke? What is the limit of private debt? Why do banks issue bonds if they don’t require funding? And why did the banks run out of money during the financial crisis?

First, let’s turn to the limits of bank credit creation:

- The availability of credit worthy borrowers

- Equity risk capital (commonly referred to as Tier 1 capital)

- Cash reserves held at the central bank (or exchange settlement balances in Australia)

- Bank risk appetite

When the economy is good, only numbers 2 and 3 above become a constraint.

As banks expand their balance sheets, they need additional reserves or exchange account balances with the central bank. Yet these reserves are always provided by the central bank, because to not do so would mean the central bank loses control of the overnight cash rate (because the banks would bid up the price of required reserves). In that sense, banks lend first and seek to acquire the reserves later – which is accommodated by the central bank as part of its interest rate targeting policy[1].

Finally, in good economic times, retained profits add to bank equity which allows significant lending to low risk weighted loans (like mortgages). This means in good times credit growth tends to be very strong, and risks emerge of a private sector debt bubble.

And this is where the two sides of MMT intercept. As noted last month, when the federal government runs a surplus, the non-government sector (including households) runs a deficit. In order to maintain consumption, the private sector needs to run down savings, or run up private debt (with loans creating new deposits).

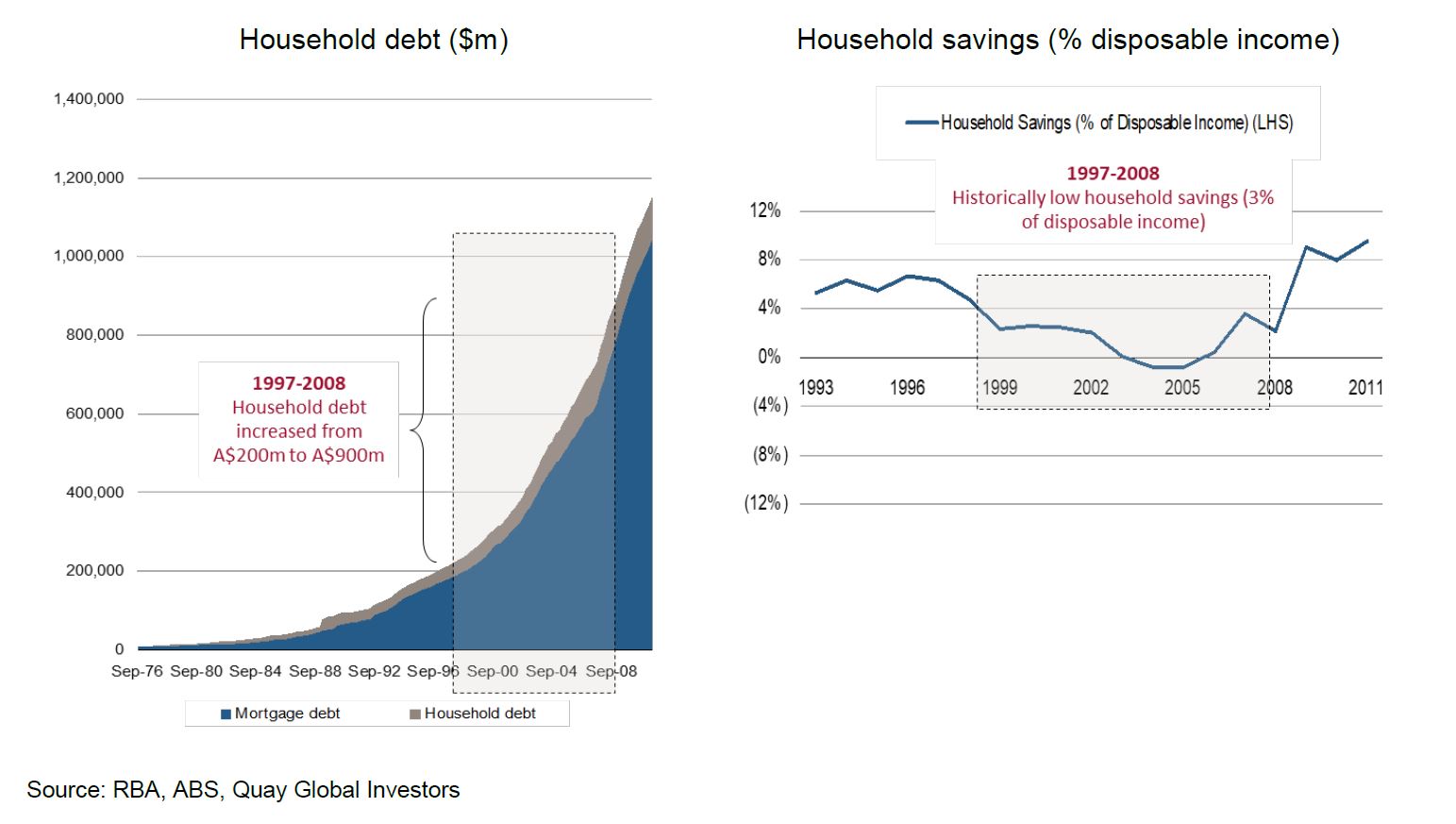

In Australia, mainstream economic commentators often lauded the Howard-Costello government for the ‘fiscal discipline’ of budget surpluses. Using the MMT framework, we know there is no coincidence that the squeezing of Australian household finances at this time coincided with the significant increase in household debt from a very low base, which maintained consumption and growth. In short, the very high levels of household debt in Australia today reflect the legacy of low budget deficits and surpluses of prior governments.

By now you may be wondering: if loans create deposits, why do our banks bother issuing bonds (foreign and domestic)?

The answer is banks issue bonds not to raise new money, but for liability management.

For example, when a bank issues a bond to the domestic market, how is it settled? To buy a bank bond, the buyer must have a bank deposit. This means bank funding already exists at the time the bond is issued. Upon settlement, total bank liabilities are unchanged – there are less deposits, but more bonds. Only the term and nature of the funding has changed. The analogy is like a home owner converting part of their variable rate mortgage to fixed. No new funding, just a reclassification of existing liabilities.

While the idea of endogenous money is now becoming more mainstream (although many like Paul Krugman still believe in the loan-deposit framework), MMT understood this idea decades ago. It was with this insight that leading MMT academics understood the unconstrainted nature of bank lending and warned of the dangers of excessive private debt almost a decade before the onset of the financial crisis in 2008[2]. Today in Australia it may feel the same warnings are again been ignored.

Savings do not fund investment – investment creates the savings

How often have we read that, as a country, we need to have savings to fund new investment? Part of the rational of the Superannuation Guarantee Levy (SGL) was to ensure not only that Australians had a retirement nest egg, but that as a nation we had a savings pool to fund investment.

However, as Australians contribute to their superannuation account, most of the capital is simply swapping one form of savings for another. For example, when investors use their superannuation to buy shares or bonds, they are simply acquiring shares and bonds already in existence. The sellers of these securities are the new owners of the cash – and the net pool of savings is unchanged.

Again, the stock-flow consistent MMT framework highlights the inconsistencies with mainstream economic thought.

So outside of net government spending, where do savings come from? Let’s look at an example.

Assume a company is formed with the sole purpose to build a bridge. It has $30 of cash in the bank via equity raised from shareholders, but no other assets or liabilities. Note the $30 in equity was sourced from existing savings from the public. Let’s see how this existing saving can create new savings.

Now the company applies (and receives) a $100 loan for the bridge. The loan creates the deposit, and the new $100 deposit along with the existing $30 is then spent paying workers to build the bridge. Upon completion of the project:

- The company has $100 in loans and $130 in assets (a bridge). The net equity of the company ($30) remains unchanged.

- Workers now have an extra $130 in their bank accounts for their labour.

The economy started with $30 in savings (which was the initial equity of the company). However, after borrowing and spending an additional $100 for the bridge, the economy now has an additional $130 in savings sitting in the accounts for the workers. The $130 bridge investment created the savings.

This is why, from an MMT perspective, private sector investment plays a critical role in the real economy.

MMT, the current account deficit, and trade

Countries that run a trade deficit are winning the trade war.

Yes – that’s right. Trade deficits add to national wealth, and countries running a trade surplus are in fact losing the trade war.

This insight stems from the recognition that, at a country level, currency is not a scarce resource. Recall from last month’s Investment Perspectives that the main constraint for a country (and its government) is not the currency but the availability of real resources. When a country imports more than it exports, it is increasing the country’s access to real goods and services.

Again, MMT insights run counter to mainstream economic thought – not for the sake of being different, but due to its emphasis on real resources in an economy. The economic zeitgeist is so radically skewed to monetarist ideology that a change in thinking will appear radical. If you are still doubtful trade deficits are a benefit, it’s probably best explained via an analogy courtesy of Warren Mosler’s book “Seven Deadly Innocent Frauds of Economic Policy”:

“If General MacArthur had proclaimed after World War II that since Japan had lost the war, they would be required to send the U.S. 2 million cars a year and get nothing in return, the result would have been a major international uproar about U.S. exploitation of conquered enemies. We would have been accused of fostering a repeat of the aftermath of World War I, wherein the allies demanded reparations from Germany which were presumably so high and exploitive that they caused World War II. Well, MacArthur did not order that, yet for over 60 years, Japan has, in fact, been sending us about 2 million cars per year, and we have been sending them little or nothing.”[3]

Of course, Japan does not technically get “nothing” – they accumulate US dollars because of trade. However, as we have learnt, from a US perspective dollars are not a scarce resource. Instead, Japan is utilising its local real resources for the benefit of another country (the USA). This allows the US to use its real resources for other activities (such as amass a large standing army).

Foreigners do not fund the current account deficit – we fund it

One of the pushbacks with MMT’s view on trade is that countries cannot run trade deficits forever. This line of thinking sometimes stems from the idea that if a country runs a trade or current account deficit, it has to be ‘funded’ by external parties – implying countries like Australia or the USA are reliant on foreign capital and therefore currency users.

In actual fact, we (Australia) automatically fund our current account deficit and can do so indefinitely.

Let’s look at an example.

Imagine you wish to buy a new car. We (Australia) generally acquire this item from overseas. In this example, let’s assume the car is produced in Japan.

To purchase the car, you approach your bank for a loan. When approved, the loan creates the deposit, and you pay the local dealer for the new car. The dealer converts the AUD deposit to Yen in the foreign exchange market and acquires the new car from the manufacturer in Japan.

In the FX market, there is always a counterparty. Someone sold Yen and acquired AUD from the car dealer and placed that money back on deposit in the Australian banking system (where else can they store it?).

So, the end result is:

- The Japanese manufacturer is happy as they have made a sale in Yen and can pay their workers and shareholders accordingly;

- The buyer of the car is happy (otherwise they would not have bought it);

- The new owner of the AUD deposit via the FX market is happy (otherwise they would not have bothered buying AUD);

- The Australian banking system remains fully funded; and

- Australia has a trade deficit of one car.

You can see with this simple example there are no foreign institutions funding the deficit. The funding came from an Australian bank (creating a deposit with the loan). There will be no grandchildren forced to pay higher taxes to pay back the deficit. There is no trade imbalance. There is no hidden agreement to supply Japan with a car at some point in the future. Everyone got what they wanted, and at no stage did Australia ever ‘import’ foreign funding.

The constraints of external trade

As discussed in last month’s Investment Perspectives, while the government (and country) is not financially constrained, it does not mean there are no limits on how large a budget deficit can be (as budget deficits do matter). The same can be said for trade deficits.

Ultimately, the car transaction described above can only occur if there is global appeal for the AUD. As readers will recall, the government can ensure the AUD has local value with enforceable taxation laws. But we cannot enforce taxation on foreign consumers or institutions in the same way.

Instead, countries like Australia ensure their currency has global value in two ways:

- There are some real goods or services produced that are desirable for foreign consumers (e.g. iron ore, education, tourism etc); and/or

- There are relatively attractive investment returns, underpinned by transparent, enforceable rule of law and rights for all owners of capital.

The second point probably needs further explaining.

Recall from our car example above, someone was seeking to acquire AUD in the FX market. The trade deficit of ‘one car’ cannot happen unless another foreign individual or entity is willing to hold AUD.

What is the benefit or attraction of holding AUD? It’s because Australia (and the USA, UK, New Zealand, Canada) are seen as safe jurisdictions for foreigners to hold capital.

Limited (or no) capital controls, well-defined property rights, and a well-regulated banking and capital markets system means the rules for capital are well known. Outside the developed markets, these rules are rare and therefore a country like Australia is a very attractive place to allocate savings and capital.

And while mainstream economics teaches that trade deficits come first, resulting in a foreign capital surplus, MMT offers a separate insight – that is, the demand for AUD comes first (due to the attractive nature of Australia’s regulatory and institutional environment), resulting in a trade deficit.

In many respects, this is why a policy of returning a country like the USA to a trade surplus is largely futile. As long as foreigners wish to accumulate savings in the local economy, that economy will always have a current account deficit by the simple rules of accounting. There has been no better example of this than in the US: despite the use of tariffs to curb the trade deficit, recent US company tax cuts have made allocating capital to the US more attractive. The result has been a stronger US dollar, and an increase in trade deficits.

Conclusion

Last month, we at Quay introduced readers to MMT from the perspective of government spending because the vast majority of public media ‘hot takes’ have focused on this aspect of the MMT framework.

The purpose of this article, however, is to highlight that MMT goes far beyond government deficits and explains the role of the monetary system across the private sector and external trade. The key points to remember include:

- Currency issuers such as Australia are not reliant on any foreign capital.

- Not only does a currency issuing government create dollars via net government spending, so does the private sector via the domestic banks.

- The real wealth of a country is measured by access to and availability of real resources (rather than dollars), and therefore trade deficits are really an economic benefit and trade surpluses are an economic cost.

- Sovereign currency issuing countries that run current account deficits do not rely on foreign capital for ‘funding’. Current account deficits are funded via domestic money creation (private credit or government spending).

- To sustainably run trade and current account deficits, the local currency must have value on the world stage – in developed countries like Australia, a well-defined legal framework for asset owners, a regulated banking and capital market, and lack of capital restriction gives foreign investors the confidence to allocate some of their savings in Australian dollars.

- It is therefore no surprise that developing countries operating with a currency peg, capital controls, and a developing banking and capital market tend to have ongoing trade surpluses (and, by definition, capital account deficits).

Over the past two months I have tried to give a brief summary of MMT and why there is far more to the framework than recent public commentary suggests. Like any framework, it does not pretend to answer everything, but its track record has been strong. Those who have followed MMT over time knew QE would not cause inflation; government deficits would not force up interest rates; the currency union in Europe would be too restrictive in a time of crisis; Japan was never going to default despite the large deficits; and private sector debt is far more problematic than government debt.

So, at least for me, MMT provides more answers applicable in the real world than traditional economics. And in our business, getting it right is more important than sounding right.

That’s why I believe over the next few years you’ll hear a lot more about it.

Download a copy of the article here.

[1] For more on this, see Appendix A of our April 2019 Investment Perspectives article

[2] Bill Mitchell, MMT predicts well – Groupthink in action, 6 February 2017

[3] Warren Mosler, Seven Deadly Innocent Frauds of Economic Policy, pp59-60