Much of this volatility can be attributed to geopolitical concerns and trade, but focus on the Federal Reserve’s balance sheet has also played its part. Indeed, the US central bank’s comments in December that the ‘unwinding’ of the balance sheet was on automatic pilot[1] seemed to be the source of much of the year end volatility. More recently, comments from the Fed suggests it may be ready to halt the balance sheet unwind some time this year – and in fact, almost all the committee members at the January policy meeting wanted to stop the balance sheet run-off in 2019[2]. It was no surprise, then, that world equity markets posted a solid return in February, up +5.5%.

It seems that to predict the market, one needs to predict the run-off (or otherwise) of the central bank’s balance sheet. But from a fundamental perspective, does the size of the balance sheet even matter?

A short history of Quantitative Easing

Following the financial crisis in 2008, the US central bank reduced interest rates to 0.0-0.25%. However, the consensus was that more needed to be done to prevent the US economy from sliding into a second great depression.

To inject more stimulus into the system, the Fed began buying long-dated Treasuries and mortgage back securities in an attempt to increase the availability of credit to the private sector. This was dubbed Quantitative Easing (or QE).

In 2010 the economy recovered, but was still operating below capacity (unemployment was approximately 9%). QE2 began just three months after the end of the initial QE, with the intention of acquiring a further $600 billion worth of US Treasuries over eight months. QE2 ended 30 June 2011.

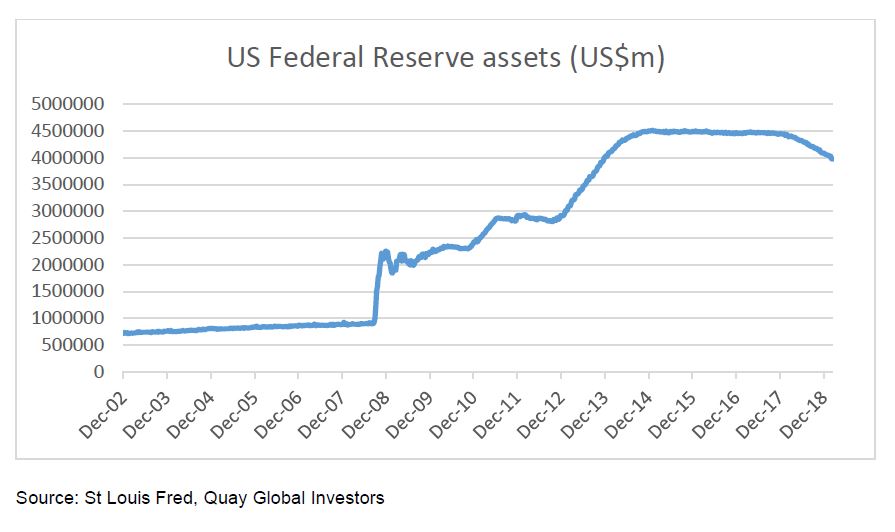

Frustrated by the economy’s lack of momentum, the Fed called upon a third round in September 2012. On this occasion, instead of a volume target of Treasuries the Fed took a monthly approach to purchases – the initial budget was $40 billion per month, but was subsequently increased to $85 billion by December 2012. Part 1 of this monetary experiment began to end in June 2013 when the Fed announced they intended to ‘taper’ the rate of purchases as the economy steadily improved, and QE3 eventually halted by mid 2014. By this time, total Fed assets had increased from US$800 million pre-crisis to over $4.4 trillion.

So, did QE work? Supporters argue that its implementation achieved two desired outcomes:

- Increased liquidity to the financial system, easing credit conditions and allowing the banks to lend more than they otherwise would or could, and

- Placed downward pressure on long-term interest rates, reducing the price of credit and therefore encouraging investment.

Evidence suggests neither of these factors really occurred with the implementation of QE. The US economy never fully recovered, eight years after the crisis. However, we accept there is the counter narrative that without QE the economy would have been much worse.

To explore whether QE was really effective (and therefore the balance sheet unwind is in fact a risk), it is best to turn to its mechanics.

The mechanics of QE

Like any entity, the US Federal Reserve has a balance sheet consisting of assets and liabilities.

The liabilities are cash reserves held by the commercial banks, and issued notes held by the private sector. These liabilities mirror the private sector’s assets, dollar for dollar.

The assets include repurchase agreements and government securities. Under QE, the Fed expanded its balance sheet by acquiring assets (mainly long dated securities) for cash. Fed assets and liabilities simultaneously expanded.

So, where did the cash come from? As Ben Bernanke said during an interview on US 60 Minutes in 2009:

“It’s not tax money. The banks have accounts with the Fed, much the same way that you have an account in a commercial bank. So, to lend to a bank, we simply use the computer to mark up the size of the account that they have with the Fed.” [3]

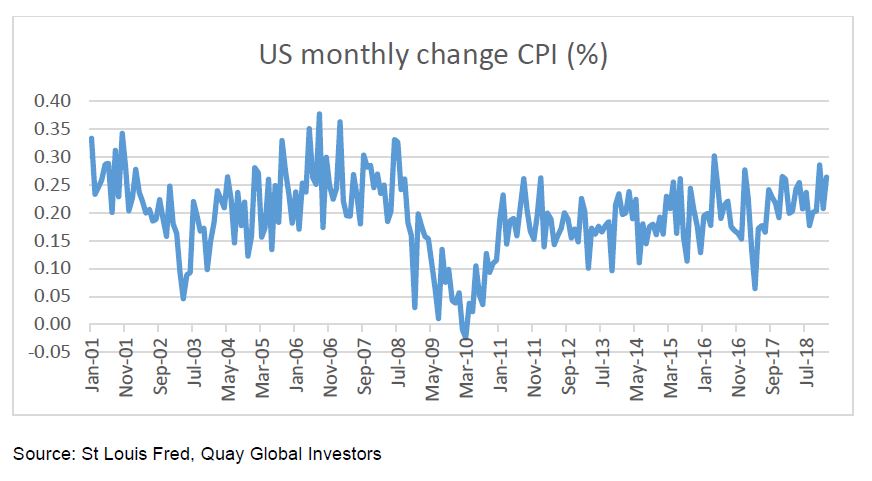

This is why QE is often referred to as money printing. If the money to buy the Treasuries wasn’t sourced from somewhere specific, then the Fed was ‘printing’. This led to many predictions that QE would be inflationary – but the reality was that US inflation never accelerated during QE. Why?

While Bernanke was correct from an operation perspective, QE wasn’t actually printing any money. Viewing QE from a private sector perspective, it simply swapped long dated securities previously held by the private sector for cash – the operational equivalent of moving the private sector’s term deposits to an at call deposit. There was no new money being created in the private sector – just a shift in the term structure of assets.

It is no surprise, then, that after more than 10 years since QE was first implemented, there has been no meaningful acceleration in US inflation.

Did QE add liquidity to the financial system?

Yes – but that additional liquidity wasn’t used to buy shares or lend to new customers.

Turning to the mechanics again, when the central bank acquires assets from the private sector, they settle with cash. This cash resides as a liability on the Fed’s balance sheet, and an asset for the commercial banks. This cash is called reserves.

Banks don’t use reserves to acquire shares or property on the market, or to make loans (see more on this later). Reserves are used simply to settle transactions on behalf of customers. Adding more reserves to the banking system did not add (or detract) from the banks’ ability to meet their clearing obligations. At the margin, it probably hurt bank profitability since the return on cash reserves was lower than the yield on the bonds the banks sold.

Did QE lower interest rates or spur credit growth?

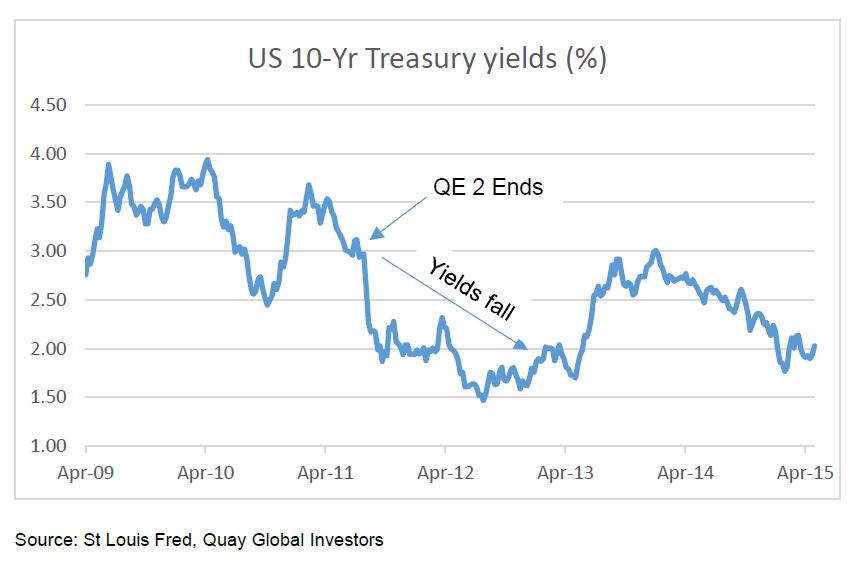

Again, the data is not supportive of this thesis. In fact, rates were lower when QE was no longer operational.

Back in 2011, the US Federal Reserve telegraphed that QE2 would end 30 June. Bill Gross, then bond manager at Pimco, asked if the Federal Reserve no longer buys the bonds, then who will?[4] He was implying that the end of QE would result in a rise in bond yields. In fact, the exact opposite occurred.

Why? Because at the same time, S&P downgraded US government credit – meaning markets feared more austerity from Washington, in turn requiring the Fed to keep interest rates lower for longer. This suggests bond yields are more influenced by the expectation of the future Fed funds rate than by the balance sheet or asset purchases.

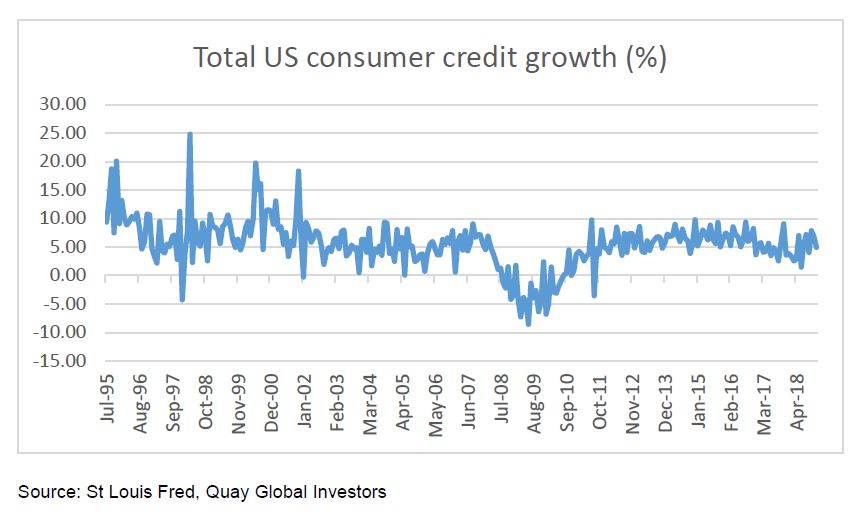

But did QE spur acceleration in private lending? Again, the data isn’t supportive of this. Credit growth remained relatively indifferent during and beyond the QE experiment, and generally remained lower compared to pre-crisis levels.

This isn’t surprising when one considers that bank lending is not driven by bank reserves, but by bank profitability. That is, a new loan is created when banks find credit-worthy customers (of which there were relatively few in a post GFC world).

As S&P noted in a paper released in 2013, banks cannot and do not lend out reserves[5]; but the process of lending actually creates the deposit. So, adding reserves to the banking system via QE did not help bank lending. The slow economic recovery and the corresponding increasing pool of credit-worthy customers did.

The Federal Reserve balance sheet – much ado about nothing

We believe the evidence that QE and the expansion of the Fed’s balance sheet provided any stimulus to the US economy is weak. Interest rates fell when QE2 ended (contrary to expectations), credit growth remained weak, and the US economy never fully recovered from the financial crisis as unemployment remained stubbornly high.

Understanding the mechanics of QE explains much of this. QE is not ‘money printing’, but more of an asset swap between the central bank and the private sector. And just as ‘expansion of the balance sheet’ is simply a swap of private sector bonds for low-yielding cash, the reduction of the balance sheet is the reverse process. The ‘draining of liquidity’ should be of no real concern if the initial liquidity was of no value in the first place (so long as commercial banks have enough reserves to meet their clearing obligations).

So, if QE and balance sheet expansion did little to help the economy, then the reduction of the balance sheet will not be much of a headwind – outside of a placebo effect.

How does this affect Quay’s investment approach?

At Quay we spend some time thinking about the macro, but it doesn’t drive our approach. Any economic downturn will negatively affect our performance (as it will for most risk assets), but it would be easy to spend too much time trying to predict such events. What is important is to know what not to worry about.

We prefer to focus on good companies with macro tailwinds not influenced by central bank policy (such as ageing demographics and affordable housing). Along with robust balance sheets and attractive valuations, we believe this means we will be well placed to meet our CPI + 5% objective over the economic cycle irrespective to what the Fed does with its balance sheet.

Download the full article here.

[2] bloomberg.com/news/articles/2019-02-21/-spooked-fed-s-sudden-balance-sheet-shift-attracts-criticism

[3] See 60 Minutes transcript (michaelreinstein.blogspot.com/2009/03/ben-bernanke-on-60-minutes-complete.html)

[4] pragcap.com/who-will-buy-bonds/

[5] kreditordnung.info/docs/S_and_P__Repeat_After_Me_8_14_13.pdf