During September we attended the Bank of America Merrill Lynch Global Real Estate Conference. Held in New York, the conference gave us the opportunity to meet many of our investees, as well as companies that attract our interest. Below is a summary of the key themes emerging from our meetings.

Multifamily

We met two multifamily owners – Apartment Investment Co and UDR Inc. (the Fund is invested in both).

It is a strong market when the key area of concern from investors is: “why has the current rental growth rate not accelerated from the 6% you recorded last year”?

There is little doubt the fundamentals of multifamily remain very strong. It is true supply is emerging in some markets. Indeed the current national supply rate of multifamily apartment /communities is around 400k per annum – in line with the pre-GFC peak. However, rental growth remains strong across many of our investees for two reasons:

- the general rule of thumb is one multifamily dwelling is needed for every five to seven new jobs. Since annual job growth in the US is roughly 2.5m, demand and supply is well balanced; and

- lack of new supply in the single dwelling market (still well below pre-GFC peaks) means this old rule of thumb currently does not apply. The ratio of jobs to supply is now lower as more new households select rentals over ownership.

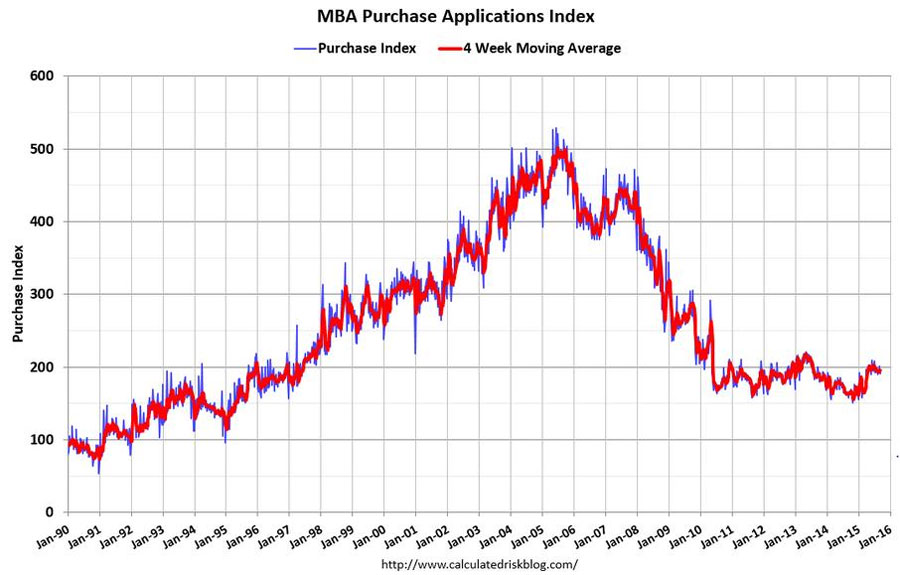

The non-recovery in mortgage applications highlights what appears to be a strong secular shift away from ownership toward rentals and this is good news for the multifamily sector.

Other multifamily themes to emerge include:

- Austin, Boston and Seattle are performing better than expectations (most supply in Seattle is located downtown);

- NY a little “soft”. B grade assets are performing better than grade A;

- DC is “tuning the corner”. Supply has been absorbed, and 2-3% rental growth is beginning to emerge in some locations;

- LA and the Bay areas remain extremely strong;

- land values are rising – development is becoming increasingly expensive; and

- Houston is softening as employment in the oil related industries becomes more uncertain.

Storage

The storage sector continues to perform strongly with same store NOI growth at 7-8% per annum for most owners. Generally, the industry continues to benefit from on- going lack of new supply. With no new meaningful completions for the next two years, this rental growth is expected to continue – although occupancy gains will be difficult from here on as most facilities are now near capacity. In fact, some operators are turning away customers in select locations.

The lack of supply comes from two broad issues:

- resistance from local government (and residents) to support an industry which brings little by way of local jobs or taxes (especially compared to commercial development); and

- finance still difficult to obtain. Pre-GFC, local developers could attain 90-100% developer finance, today the number is closer to 70%.

A more recent trend has been the increased usage of e-commerce that has turned a local industry into a regional industry. In the past, marketing of a storage facility was a local effort - local newspapers, Yellow Pages etc., drove occupancy and rents. Today, storage operators devote substantial human resources to search engine optimisation. All operators commented that a meaningful number of enquiries now come from mobile devices.

The result is that local developers and owners are finding it difficult to match the performance of companies with scale and a real barrier to entry is starting to emerge within the sector. It is the local developers operating without these scale benefits and for whom finance remains difficult, that are responsible for most of the incremental supply. These constraints may lead to the demand/supply imbalance continuing for some time yet.

Other storage themes include:

- private equity is now attempting to enter the market – acquisitions may become more difficult as cap rates become “very tight”;

- direct cap rates today are sub 5% in “high barrier to entry” markets (e.g. New York). For the most part, cap rates are generally in the 5-6% range;

- despite the trouble in the oil industry, Houston continues to attract good demand. Sovran Storage notes occupancy in that market is in line with their entire portfolio;

- DC and Phoenix appear to be a little soft (which is a relative term) due to pockets of supply; and

- some West Coast markets are very strong with same store rental growth +17% yoy. Supply constraints are exacerbated by the California Environmental Quality Act (CEQA) legislation making it almost impossible to develop. CEQA makes environmental protection a mandatory part of every California state and local agency's decision making process.

West Coast office

Net absorption remains strong and rental rates continue to accelerate, while the supply picture is mixed.

Silicon Valley represents the market with the highest supply growth at 8m square feet expected over the next two years (about 1/5th of Sydney’s CBD). Around 3.5m of this represents Google and Facebook headquarters – and by all accounts the remaining supply has been largely pre-committed, presumably from other buildings. There does, however, remain the issue of back filling the vacating space.

A better supply story is LA, particularly in the West Los Angles/Sherman Oaks ring which is dominated by Douglass Emmitt. This market has had virtually no Class A space supply delivered in the past 15 years, and nothing material expected in the near future. Consequently rents are accelerating.

Direct market transactions reflect low 4% cap rates and capital values around $800-$1,000 per square foot. A price range that is at (or above) replacement cost (depending on land price assumptions). We note the implied capital values per square foot of the listed REITs are well below these levels.

We visited LA and while our time there required us to be restricted to certain locations, it was refreshing to note the very limited number of observed cranes – especially after arriving from Sydney! We left feeling the main risk to the LA market will be come from lack of demand (recession) rather than excess supply.

New York office

We attended a tour of the New York office in the mid-town and Hudson River precincts. The overall mood was generally positive, with good leasing velocity (gross absorption) experienced during the 3rd quarter and tenants seeking longer term lease commitments, suggesting improving business confidence. Almost all incremental demand since 2010 has come from the technology and media sectors, while financial firms and associated industries are still downsizing.

Market rents are rising – up around 5-10% in most locations year-on-year.

Direct market sales range between $1,000-$1,400/square foot in midtown, which is well above replacement cost of circa $1,000/ square feet (all in). Not surprisingly, there is an expectation of a consistent flow of new supply over the next five years.

At one presentation, we learned that total new supply across Hudson, Midtown and Downtown precincts will deliver 13.6m feet (or 3.4% of existing stock) by 2020, which compares to total net absorption since 2010 of 16m feet. Consequently, if demand remains consistent over the next five years the market should remain well balanced.

|

Million feet |

% of stock |

|

|

Total available space |

42.4 |

10.6% |

|

Future supply |

13.6 |

3.4% |

|

Historic absorption 2010-15 |

-16.0 |

-4.0% |

|

Forecast availability |

40.0 |

10.0% |

We have a few concerns with this dynamic:

- 2010-15 historic demand (averaging 0.8% of total stock per annum) was driven via employment growth from a low base and above the long run average of 0.5%. For this forecast to be realised, the US economy will need to experience 11 years of uninterrupted economic expansion – which is very rare in historical context; and

- with direct market transactions exceeding the marginal cost of supply, it is likely the supply number will increase over the next few years.

Another emerging theme is tenants’ requirement of lower workspace ratios (square feet per occupant). One company we met suggested this was not even an issue five to six years ago, but today buildings need to deliver services that can accommodate a work space ratio of 130 feet/person that is roughly half the existing workspace ratio.

This trend has already occurred to a large extent in Australia, particularly Sydney. The impact is subtle but effectively means demand needs to be double when viewed in historical context. The outcome is actual rental growth tends to disappoint while this trend plays out.

Manhattan landlords are likely to enjoy strong same store rental growth in the near term as old (below) market rents are re-leased to market. Empire State Realty Trust has significant reversionary income upside (especially in retail) in this respect.

Shopping centres

We met with one shopping centre owner (as opposed to a mall owner) that specialises in grocery and needs-based retail. Sales remain robust while supply remains very low. Major anchors are unwilling to commit to new stores, yet demand from smaller specialty retailers remains unsatisfied. The result is strong year-on-year rent growth (3-3.5%) and rising occupancies. In our view, needs-based retailing remains well insulated from physical and online competition.

Student accommodation

The conference occurred at a time that is critical for most student accommodation operators – the end of the leasing season. The mood was upbeat, which was confirmed by a subsequent announcement from one group with leasing outcomes (rate and occupancy) at the upper end of expectations.

Year-to-date leasing has been impressive in the context of historic supply in excess of underlying demand. To achieve CPI+ rental growth in this environment supports the thesis modern supply does not directly compete with older style accommodation. It is easy to draw parallels with Canberra office in the late 1990s where obsolescence can sometimes overstate real supply.

The demand/supply outlook is expected to improve considerably into 2016, with forecast supply growth of 0.8% compared to demand growth around 1.5%. It will be interesting to see to what extent the landlords will push rents in portfolios that are effectively fully occupied.

The regeneration opportunities across many US universities remain significant. The trend to develop accommodation within easy walking distance to campus has evolved where now the preferred opportunities are on-campus redevelopments in joint venture with the universities. These sites are regarded as having very low risk of vacancy (especially at the larger +30,000 student universities) and excellent pricing power, albeit capped in most instances.

Concluding thoughts

At a time where it is easy to be distracted by the Federal Reserve Banks’ intentions and the noise of the market, it was refreshing to discuss the underlying fundamentals with the CEOs and CFOs of leading real estate companies.

We came away confident that many of our identified themes remain broadly unchallenged. While supply is emerging in some markets, it remains generally muted. High quality businesses and portfolios are well place to extract CPI+ style rental growth in the medium term. Along with targeted development opportunities and acquisitions funded from retained cash flow, robust Funds From Operations (FFO) growth across many of our investees into 2016 appears likely.

Disclaimer

The content contained in this article represents the opinions of the authors. The authors may hold either long or short positions in securities of various companies discussed in the article. The commentary in this article in no way constitutes a solicitation of business or investment advice. It is intended solely as an avenue for the authors to express their personal views on investing and for the entertainment of the reader. In particular this newsletter is not directed for investment purposes at US persons.